Name Ruchira Paper

Type of Report Fresh Recommendation

Report Date 10-Jul-2015

Price on Report Date Rs. 32-33

Current Market Cap Rs. 70-75 Crores

View Buy

Indicative Target Price* Rs. 55-60

A) Company Background: Ruchira Paper is a Himachal Pradesh based paper manufacturer that uses agriculture residues as its major raw material rather than the traditional raw material wood pulp which is quite difficult to source. Ruchira Papers is established in 1980 by 3 technocrat partners and tapped capital markets with IPO in November 2006.

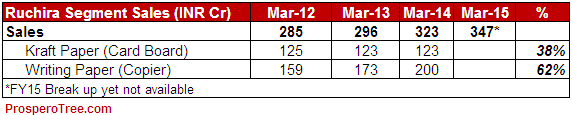

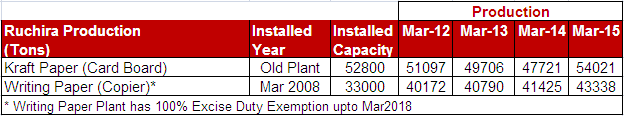

In FY15, Ruchira clocked total revenue of Rs. 347 crores, net profits of Rs. 13 crores and cash profit of Rs. 23 crore. The company has a capacity to produce 33,000 tonnes of Writing Paper and 52,800 tonnes of Kraft paper.

B) Investment Arguments

1) Efficient Promoters: Promoters of Ruchira being technocrats were able to increase production higher than the installed capacity without any major capex but minor debottlenecking exercise. In FY15, the Kraft Paper production reached 102% while that of Writing paper reached to 131% of its capacity.

2) Easy availability and flexibility of use of raw materials increase competitiveness against wood pulp: Ruchira Paper produces paper from the agricultural residue like Wheat Straw, Bagasse, Rice Straw, Sarkanda, etc. Ruchira has its plant located at exterior of Himachal Pradesh that helps to procure agriculture residues from neighbouring states of Punjab, Haryana and Uttar Pradesh. At the same time, per ton production cost of paper from agricultural residue is lower than that from the imported wood pulp. Easy availability of raw materials and its relatively lower cost has made it possible for Ruchira to be fairly competitive paper producing company.

3) Captive power plant fulfilling major power requirements: In order to assure uninterrupted power supply for writing and printing paper plant, the company has its own 7.2 MW co-generation captive power plant. Combination of Agri residues (Bagasse, Rice Husk, etc) and Pet Coke (residue of Crude Oil) are used as feed stock for this power plant. In case of Kraft Paper plant, the electricity is procured from the state electricity board.

4) E-commerce led demand of Kraft Paper to benefit Ruchira: Ruchira produces Kraft Paper as well as Writing Paper. Usually Writing paper commands a higher realisation and higher margin when compared to Kraft Paper. However, the recent boom led by e-commerce websites like Flipkart, Amazon, SnapDeal, etc raises tremendous demand of corrugated boxes which are made out of Kraft Paper. To capture this opportunity, Kraft paper production for Ruchira grew by 14% over FY14. Efficient utilisation of Kraft Paper facility will help the company grow its topline and improve the margins.

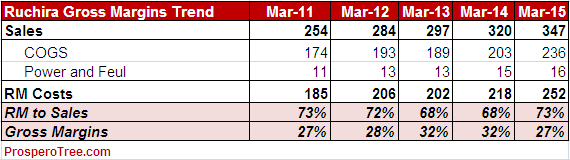

5) Margin improvement on cards: Owning to a sharp increase in cost of Wheat Straw since Jan2014, Ruchira's gross margins fell from 32% in FY14 to 27% in FY15.

However, the margins should increase back to 30-32% range as:

- Normalisation of wheat straw prices

- Use of Bagasse as alternative agri-feed to ease dependence on Wheat Straw

- Improvement in Product Mix

- Pet Coke prices will remain under pressure due to sharp fall in crude prices

- Improving efficiencies through debottlenecking

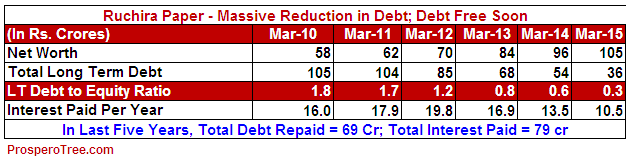

6) Debt Free Status Soon: Ruchira Paper set-up up a new writing paper plant, captive power plant and a chemical recovery plant for a total cost of Rs. 130 crores. Nearly 80% of the cost of this project was funded by Debt and the company had a long term debt of Rs.105 crores in FY10. Since then the company has reduced its debt to Rs. 36, a reduction of Rs. 69 crores in 5 years (Ruchira's MCAP = Rs74 crores).

7) Attractive Valuation: At the current market price of Rs. 32-33, Ruchira is trading at a market cap of Rs. 74 crores. Considering all the valuation matrix, Ruchira paper is available at a steep discount to its intrinsic value.

- Cash Flow: Based on its current profitability, Ruchira generates free cash flow of Rs. 23-25 crores per year. With small increase in sales, increase in margins and saving in interest costs due to reduction in debt, Ruchira has a potential to substantially increase its free cash flow generation. Based on current cash flow, Ruchira is trading at throwaway valuation of 3 times cash flow.

- Price to Earnings Ratio: Based on its current profitability of Rs. 13 crores, Ruchira is trading at a price earnings ratio of 5-6 times. We believe that Ruchira has a strong case of earnings expansion as well as PE multiple expansion.

- Book Value: Currently the book value of the company is Rs. 46 against its current market price of Rs. 32-33.

- Dividend Yield: For the last 2 years, the company has started paying dividends and the company will continue to maintain / increase the same. At the CMP of Rs. 33 and a dividend of Rs. 1.2, the stock is trading at a yield of 4% which further add to the safety at the current market price.

C) Investment Risks:

- Sharp increase in raw materials price

- Competition from large players

- Lower Growth in Paper Demand due to digitization

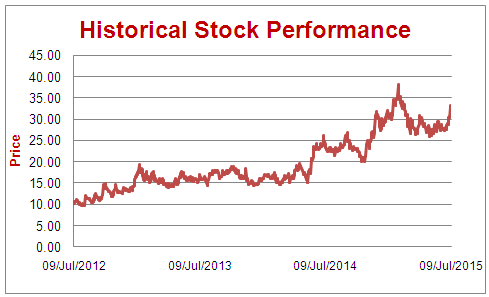

Historical Stock Price

*Achievement of Target Price does not imply Sell. We will explicitly release a Exit/Partial Sell Report at an appropriate time.

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

1. Explanation of Type of Report

Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

2. Explanation of Time Horizon: All the Fresh Recommendation reports in the investing section have a view of 3-5 years.

3. Explanation of Views: Views can be any one among these - Buy, Buy on Dips, Hold, Sell Partial, Exit

Buy: This means buying the concerned stock at current market price.

Buy on Dips: This means buying the concerned stock on the explained fall in price.

Hold: This means holding the concerned stock until further update.

Sell Partial: This means selling half of the existing position in the concerned stock.

Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.