We had first recommended Ruchira Paper: Profits from Agri-Waste to be accumulated between Rs. 32-33 in July15. We re-recommended it to be bought at Rs. 42-44 with our report titled Ruchira Paper: Defining Results. The current market price of Ruchira Paper is Rs. 78-79, indicating a return of 141% so far (dividends extra).

We further recommend to BUY Ruchira Paper at Rs. 78-79 considering its potential.

Here is a short update on Ruchira Paper:

1. Capacity Expansion Completed: Ruchira has recently completed a capacity expansion for approximately Rs. 35 crores. The capacity increase is done mainly for:

-

Increasing Kraft Paper output by changing 2 machines with better capacity

-

Improvement in Boiler recovery

-

Changes in Turbines of a Power Plant

-

Improving the speed of writing paper plant

2. Expansion Provides Strong Visibility of Volume Growth: In FY11, Ruchira operated at 100% utilization when it produced 85000 tons of paper. Without any capex but with minor de-bottlenecking, Ruchira reached to 116% utilization by producing 99000 tons of paper in FY16. The recently done capex will now help the company to slowly ramp up their production by another 25%-30% by FY18. For FY17, the company has targeted to achieve a production of 109,000 tons, which we think is reasonably achievable.

3. Energy Efficiency to creep in too: The fuel for generating power includes Petcoke, Rice Husk and Boiler Fuel and currently stands at around 15% of sales. With the capex also targeted at lowering power consumption per unit of production, there should be some significant long term benefits coming from energy costs. In other words, the company will be able to achieve higher production without significant increase in power costs.

4. Superior Balance Sheet: The debt for the company remained unchanged from Rs. 57 in FY15 to Rs. 58 crores in FY16 even after spending nearly 33 crores on capital expenditure in FY16. Apart from the regular capex and the large Capex done in FY16, Ruchira has repaid more than Rs. 172 crores in debt and interest payments over the last 7 years. This suggests a very strong cash flow generating the ability of Ruchira. Today its total debt stands at Rs. 58 crores and can easily be paid out of its current cash flow in less than 2 years, if company does not go into any further capex.

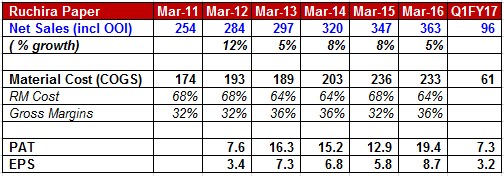

Ruchira Paper announced the highest-ever quarterly sales and profit in Q1FY17 with a sale of Rs. 96 crores and a PAT of Rs. 7.3 crores. At CMP of Rs. 78-79 it is trading at a trailing multiple of 9 times FY16 trailing earnings. The company now also enjoys superior balance sheet strength in addition to strong results. The robust results are set to continue based on volume uptick in production, operating efficiency and benign raw material costs aided by normal monsoon. We therefore suggest to BUY Ruchira Papers.

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

1. Explanation of Type of Report

Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

2. Explanation of Time Horizon: All the Fresh Recommendation reports in the investing section have a view of 3-5 years.

3. Explanation of Views: Views can be any one among these - Buy, Buy on Dips, Hold, Sell Partial, Exit

Buy: This means buying the concerned stock at current market price.

Buy on Dips: This means buying the concerned stock on the explained fall in price.

Hold: This means holding the concerned stock until further update.

Sell Partial: This means selling half of the existing position in the concerned stock.

Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.