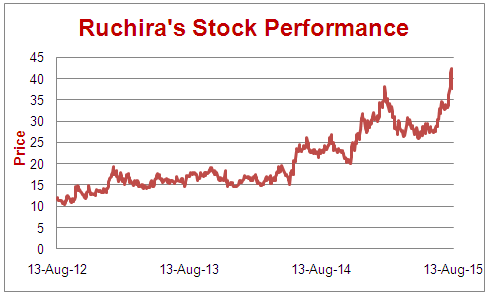

We recommended Ruchira Paper at Rs. 32-33 in July15 with a report titled, Ruchira Paper: Profits from Agri-Waste. Since then the stock has moved up to Rs. 43 (13Aug15 Closing) giving returns of 30% in a months’ time.

Ruchira Paper announced very strong results for Q1FY16. Based on its strong results and positive future outlook, we maintain a Buy on Ruchira at current levels.

Here is the Q1FY16 result update for Ruchira Paper:

- Ruchira Paper clocked Rs 93 cr of sales in Q1FY16, highest ever quarterly sales. This quarter indicated a revenue growth of 12% YoY.

- At the operating level (EBIT), Ruchira’s profits increased from Rs. 7.6 cr in Q1FY15 to Rs. 12.6 cr in Q1FY16, indicating a massive increase of 66% in operating profits (EBIT). This was mainly aided by the normalization of agri inputs costs (raw material costs) and a healthy increase in sales.

- Despite a very high provision for tax including deferred taxes of 46%, the net profits grew by 74% from Rs. 3.3 cr in Q1FY15 to Rs. 5.7 cr in Q1FY16. Higher net profit growth was aided by better operating performance and reduction in interest cost.

- At its peak debt, Ruchira paid nearly Rs. 5 crores as interest for each quarter. However, due to continuous reduction in debt, current interest cost per quarter has reduced to Rs. 2 crores per quarter. With very high operating cash flows, Ruchira will easily achieve debt free status very soon and further strengthen its balance sheet.

Conclusion: We think that Ruchira Paper's current results show a defining change in the company’s performance. At CMP of Rs. 42-43, Ruchira market cap stands just at Rs. 95 crores. Based on the current performance, extremely strong balance sheet, efficient management, and strong cash flow generation, we think that Ruchira provides extreme safety along with high reward potential. We therefore, recommend a Buy on Ruchira Paper at the current level.

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

1. Explanation of Type of Report

Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

2. Explanation of Time Horizon: All the Fresh Recommendation reports in the investing section have a view of 3-5 years.

3. Explanation of Views: Views can be any one among these - Buy, Buy on Dips, Hold, Sell Partial, Exit

Buy: This means buying the concerned stock at current market price.

Buy on Dips: This means buying the concerned stock on the explained fall in price.

Hold: This means holding the concerned stock until further update.

Sell Partial: This means selling half of the existing position in the concerned stock.

Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.