What are Buybacks?

- Buybacks are used by companies to buys back its own shares from the marketplace with the help of excess cash available with the company.

- Buybacks by Indian companies are done for a number of reasons:

- Management thinks its own shares are undervalued

- Indirectly increasing or decreasing the shareholding percentage by promoters

- Tax efficient manner to distribute cash with company as so far Buybacks don't attract dividend distribution tax.

- Unavailability of options to deploy cash for better returns.

- On Buyback completion, the number of shares outstanding is reduced and thereby leads to better return on equity for most of the companies.

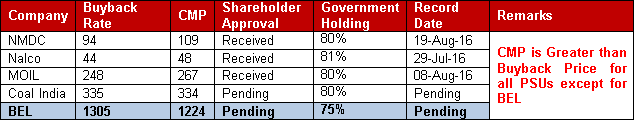

Current Buyback Programs carried out by Public Sector Enterprises (PSE / PSU)

- The Government of India has planned to raise funds from various means for their budgetary spending. In connection to this, many PSU listed companies announced series of buyback programs to distribute funds back to their shareholders.

What will the government achieve out of this?

- As soon as buyback resolution was passed, stock price of most companies increased to levels much higher than their buyback prices as indicated in the above table.

- With the market prices higher than the buyback prices, no public investor will tender their shares in the buyback.

- This will give an option to the government to tender maximum shares and thereby achieve a dual advantage:

- Fund Raising: Government will get huge amount of funds from these companies

- Decrease in Shareholding as per Listing Requirement: If during the tender period, the stock price of such PSUs stays higher than Buyback price (as it is currently), no public investor will participate in the Buyback. This will effectively help the government to decrease its shareholding

It is also important to note that in one of the interview, the Finance Minister of India, clearly stated that the government will use buybacks where-ever the stock prices of PSU companies are not reflecting its true valuations. Basically, Government of India thinks that NMDC, Nalco, MOIL, Coal India and Bharat Electronic (BEL) are all undervalued.