"You don't have to be the biggest to beat the biggest" - Henry Perot.

The biblical tale of David and Goliath bears a striking resemblance to the story of Vi-John and Gillette supremacy in the shaving cream segment. Vi-John, a brand with a very modest beginning in Delhi in 1960s, is today, the largest selling shaving cream in India, overtaking the global Goliath - Gillette. Vi-John commands a 30% market share in the shaving cream space compared to the 8% market share of Gillette - the apparent market leader. What makes this achievement even more impressive is that Vi-John attained the numero uno position without using any media platform for marketing.

How did Vi-John achieve this extraordinary feat?

Value -for- money offering in a niche market

At a time when Gillette focussed on the urban areas, Vi-John discovered a niche for itself in the tier II and tier III cities along with rural markets. After understanding the consumer preferences of these markets, a customized offering was launched an affordable shaving cream that produced more lather and possessed stronger fragrance than the competitors. It was priced lower than competition to gain market share. Over time, the value-for-money product turned very popular with the mass market.

Wide distribution network

The company capiatalized on its soaring popularity and developed a large distribution network of 70 stockists and 1,500 distributors. Vi-John gave higher margins to distributors and retailers with some retailers enjoying as much as 25% margins. Since all the stakeholders in the supply chain earned well, it gave tremendous impetus for pushing the product in the market. Vi-John quickly understood that only lower pricing will not help it attain a good market share, hence it decided to target the saloon market by converting Saloons into a separate direct channel. Vi-John offered huge discounts of 30% to 35% to Saloons sourcing from these shops, thereby deepening its penetration in the non-urban market.

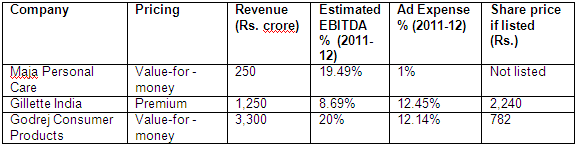

Competitive landscape

Company Background

This company was founded in 1960 by late Suchet Singh Kochar from his house at Chandni Chowk in Delhi. Vi-John got its English sounding name due to the popularity of imported products in those times. The third generation of the Kochar family now runs this Rs. 250 Crore business. The FMCG business is divided into two divisions, Maja Personal Care and Maja Healthcare. The Vi-John brand which started as a shaving cream has now been extended to numerous consumer products shaving foam, gel, hair removal cream, fairness cream, almond oil, toothpaste, talcum powder and skin cream. The company also manufactures deodorants under the popular Cobra brand. The products are mainly targeted at the rural market with a value-for-money positioning.

Re-visiting the marketing strategy

Though this push strategy worked for price sensitive rural market and saloons, when Vi-John tried to penetrate the brand conscious urban markets, results were below par. For instance, when Vi-John introduced its range of products in Mumbai, the response was so lukewarm that most shopkeepers returned a bulk of their stock back to the company. In 2011, Vi-John changed its strategy from Push to Pull Marketing. A brand that became a leader without resorting to marketing through the traditional media channels, roped in Shah Rukh Khan and other celebrities as brand ambassadors and launched a highly visible marketing campaign. This led to an immediate increase in product off-take across markets. Also, substantial repeat sales was recorded.

A bumpy ride ahead?

The incremental sales came with a significant increase in cost of advertisement and distribution; high dealer margins and massive discounts offered to saloons eroded profitability. In order to maintain its margins, Vi-John started offering only slightly higher margins than other brands. Also, the discounts offered to saloons was slashed from 30% to 10%, which is the price at which retail shops get the product, thereby leaving a very little incentive for saloons to push the brand. As a result, the saloons are shifting to other lesser known cheaper brands.

While the core strengths of the product remain in place viz. low price and quality, it remains to be seen whether the increase in retail sales is able to offset the loss in saloon market share. To continue the growth, the company has adopted a three pronged strategy. Firstly, the company is actively looking for inorganic growth in the domestic market and considering PE as well as IPO to fund the same. Secondly, it is also exploring venturing into emerging markets of Asia and Africa. Lastly, the company is diversifying into liquor business by forming a 50:50 joint venture with Spain's Mahoua San Miguel Group aimed at launching two beer brands in the Indian Market. Also with the company looking to invest cash flows from existing business into the new liquor business, concerns remain on funding to fuel the growth of FMCG business. However the success of Vi-John vis-a-vis more established brand names gives us a basic lesson on importance of astute targeting and pricing.