Why does Prospero Tree recommend you to read this article?

At Prospero Tree, it's been our endeavor to present good investment opportunities and at the same time, makes you understand the reasons that make the opportunity attractive. Although we are sub-consciously aware about the concept of tax-adjusted returns, we tend to ignore it in our investment decisions. In most cases, tax free NCDs offer highest tax adjusted returns along with the highest level of safety for individuals with large taxable income. Here is how tax-free NCDs are beneficial for you. Tax Free NCDs,

- Offer you better returns over longer durations vs. bank fixed deposits

- Are as safe as bank deposits

- Are high yielding fixed income instrument for individuals with taxable income

- Are Easy to invest and exit

Why should you prefer these bonds over bank fixed deposits?

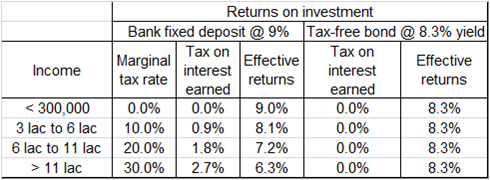

Highest tax-free interest rates: The interest earned on these NCDs is completely tax-free, irrespective of your income levels. On the contrary, interest earned on bank deposits is taxed at marginal tax rates. For a tax-paying individual, NHAI bonds represent the best available fixed income option once he has exhausted his EPF / PPF limits. The table below illustrates that even if you are in a 10% tax slab, effective returns are higher when invested in tax-free bonds.

Table 1: Comparison of effective returns on tax-free NCDs vs. bank fixed deposits

Note: most of the tax-free bonds had yields of ~8.3% during their public issue.

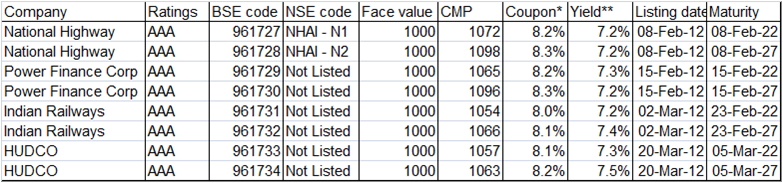

Most of the tax-free NCDs got listed around Mar-12 and have been actively traded on the stock exchanges. The general interest rates in the economy have declined as the liquidity situation has improved considerably since Mar-12 and prices of all these tax-free bonds have gone up. Table 2 illustrates the yields that an investor investing on 14-Nov-2012 would earn over the life of the bond. For investors lying in the 20% or 30% tax slab, these bonds still offer the best fixed income returns.

Table 2: Current yields on various tax-free NCDs

*prices as on 14-Nov-2012

Highest level of security: Tax free NCDs can only be issued by select entities backed by Government of India. Most of these NCDs have a credit rating of AAA from all the rating agencies, indicating high levels of safety for your money. In short, these NCDs are as safe as any bank deposits.

Listing on BSE & NSE: Although the bond has a maturity period of 10 to15 years, investors are free to sell them on the stock exchanges from day one of listing. Thus one need not worry about funds being locked up for a long time. However, investors must make a note of the fact that liquidity on stock exchanges can be low, especially after six to twelve months of listing. Trading volumes in SBI N5 series NCD suggests that large, high-quality NCDs remain liquid through the maturity period.

Potential capital gains if interest rates cool down: We have already seen some cool-off in the general interest rates since the peak of Mar-12 and expect them to trend lower over FY13-15E as macro situation improves. This can potentially lead to capital gains in your NCD portfolio. As a rule of thumb, 1% decline in interest rates will lead to approximately 7-8% appreciation in NCD price, thus giving you capital gains should you decide to sell. Thus, tax-free NCDs represent an attractive proposition even for investors who plan to sell the bonds within 1 or 2 years.

Prospero Tree View

Tax free NCDs provide investors with tax-free interest income and no upper limit on the quantum of investment and best of all safety of Government of India. It will also give the medium term investors a chance to earn some capital appreciation as the interest rates in economy cool off over FY13-15E. An ideal NCD portfolio should include a mix of corporate NCDs as well as tax free NCDs, thus offering adequate returns as well as diversification from issuer specific risk.