Why does Prospero Tree recommend you to read this article?

"The first rule is not to lose money. The second rule is not to forget the first rule" - the sage of Omaha.

It often helps to revisit the above gospel, and more so in the backdrop of what happened in the mid-cap and small-cap space over the last past few days. If you owned an equal value portfolio consisting Core Education, Welspun Corporation, DB Realty and Sudar Industries, you would have lost exactly 52% of your wealth between 12th Feb and 27th Feb, 2013. While pledged shares getting sold off and unwinding of margin positions by a large stock operator has largely been attributed to the abnormal fall in the stock price, stock market history suggests such events have recurred with remarkable regularity.

How does a retail investor identify such stocks and insulate himself from vagaries of such an unprecedented decline in his portfolio? There are remarkable similarities in stocks that have high likelihood of such declines - large chunk of promoter's stake being pledged with a financier, weak business fundamentals, price and volume manipulation by stock operators. Simple research will tell you that in most cases, such a fall is not completely unpredictable.

Business practices that makes stocks vulnerable to such sharp value destruction:

Shares pledged by promoters: The owners of the company usually hold the largest chunk of the total stock. They often pledge their shares with NBFCs such as Religare, Prime Securities, IIFL, Barclays, etc to borrow money. The general borrowing rate is 14%-18% per annum and value of shares pledged is 2x of the borrowed amount. These funds are used either for promoters own needs or for the business needs of listed company or for collaborating with stock operators to manipulate the price. A fundamentally sound business would generally avoid pledging of shares.

Weak business fundamentals: The need to borrow is highest when businesses are in trouble. A good indication of weak business fundamentals are below average sales growth, low profit margins and high debt to equity ratio. A simple look at the annual report can enlighten the stock buyer on this. Sharper decline in stock price compared to the Sensex could also be an indicator of deteriorating business fundamentals. The only case where it becomes tricky to identify business weakness is when the companies 'manage' their earnings. In this case, one can see if the historic stock prices have responded to good earnings. If not, it can indicate that markets do not believe in the quality or sustained ability of the company's earnings.

|

Pledged shares |

Profit margins |

Debt / Equity |

|

| Core Education | 47% | 20% | 0.8x |

| DB Realty | 65% | 12% | 0.1x |

| Welspun Corp | 49% | 3% | 1.3x |

| Pipavav Shipyard | 96% | 1% | 1.5x |

| Titan Industries | 0% | 7% | 0.0x |

Operator activity: A host of promoters who indulge in borrowing against shares, have a vested interest in keeping the stock price firm. This is because a fall in stock price will trigger margin call, which has to be met through pledging additional shares or through internal sources or through open market sale of pledged shares. Let's assume that the promoter has pledged 50% of his holdings and the stock price falls by 20% for some reason. He has to either pledge an additional 25% of shares or re-pay the shortfall through his own sources. One must remember that promoters who have to resort to pledging of shares hardly have the leg room to arrange funds from their own sources! Else they wouldn't have resorted to share pledging in the first place. In case he is unable to pledge more shares, the lender is forced to sell the promoter's original pledged shares in the open market. This can cause sharp stock price fall and will cause other investors to panic too. Ironically, if the price fall is very sharp, a 2nd level of margin call is triggered and a spiral begins. Stocks like Glodyne Technoserve, Neha International, KS Oils, Tulip Telecom, GTL Infra, etc have lost 90% of their value due to such spirals.

Illustration of a typical operator activity

An operator is usually a stock broker who provides margin funding to promoters i.e. they finance the promoter's stock purchase program at 15%-18% interest rates. As an illustration, promoter may keep Rs100 as margin with the operator and buy his own stock worth Rs400 (Operator charges interest on Rs300). Generally, a large stock operator operates in a similar manner - multiple stocks in collaboration with multiple promoters. In a bearish market, companies with weak fundamentals often get pounded and operators face the risk of margin shortfall. They may have to forcefully liquidate promoter's position leading to the 1st leg of sharp decline. The NBFCs from whom promoters have borrowed money against shares could potentially start the 2nd leg of fall and the cascading effect will follow. This is precisely what happened with most stocks that fell in past three days - a large operator faced margin calls and liquidated large positions, triggering a spiral effect. Identifying stocks that have large operator activity is not too easy but simple observations such as high promoter pledge and high volatility in historic stock price movement can be the lead indicators.

Some Stocks that fell hard - Cross sectional analysis

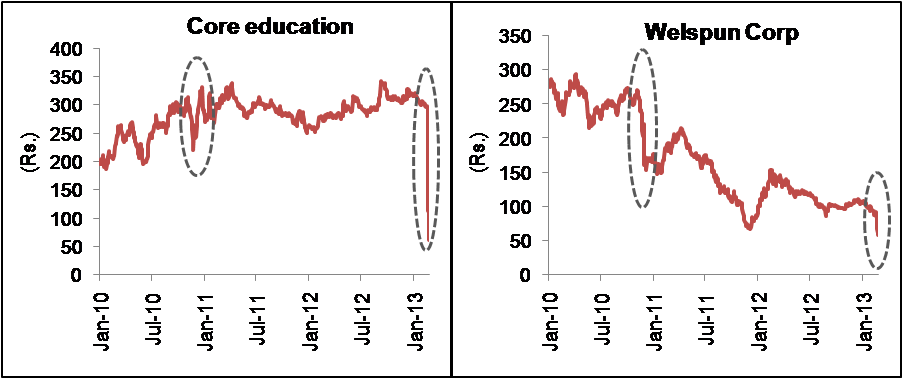

Core projects: This could have been a tricky one to identify as financials look healthy and promoter pledge is not excessive. However if one looks at the share price history, sharp stock price fall has happened twice in the past two years indicating that things are not as good as they look.

Welspun Corp: The business has clearly turned very weak. The order pipeline has dried, profit margins have shrunk to 3% and promoter pledge is close to 50%. Again, this stock has been pounded in weak markets historically too. Thus it is not too difficult to envisage such a fall. However, it is now nearly 2 years with private equity investor coming on the board of Welspun and things are beginning to turn around on the business side. As the price fell from 90 to 60, the promoters were net buyers in the stock.

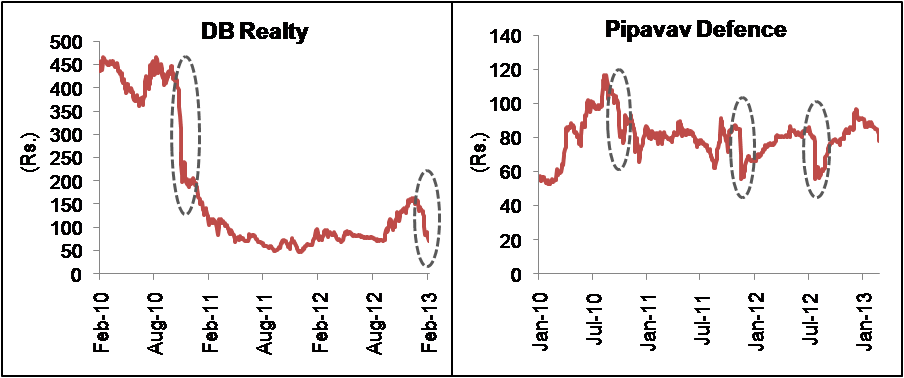

Pipavav Defense: Although the promoter group is strong and the company has tangible assets and robust operations, its business performance has been below average. Margins have declined sharply and debt/equity is elevated. This coupled with promoter pledge of 96% makes it susceptible to sharp falls. However since the promoter group is strong, the decline in prices has mostly been temporary.

DB Realty: Although the financials don't look too weak, the promoter has pledged almost 67% of his holdings. To add to this, the company is going through a phase of weak corporate governance - promoter entangled in a legal issues related to the 2G and 3G scam, projects in the Mumbai real estate market being stuck due to regulatory reasons and deteriorating cash flow situation. As such, any bad news is greeted with sharp stock price decline. Rumors are strong that the large bull investor who went on a liquidation drive held large chunk of this stock. Spiral effect followed. Also, the historical price chart shows that such events have happened in past as well.

Prospero Tree view

Basic research is the best form of defense for any investor. Risk often stems from participating in activities that we only partially understand. Through this article, we have tried to highlight few thumb rules and very primitive observations that can help you in abstaining from stocks that could leave you very poor over-night. Putting your hard earned money in stocks is akin to forging a business partnership with the promoter. You make money only if the business does well and promoter integrity is peerless. At Prospero Tree, it's our endeavor to recommend stocks that fit into that criterion.