Why does Prospero Tree recommend you to read this article?

The non-stop information bombardment that happens through the media and the financial portals during Budget can falsely lead you to believe that Budget plays a crucial role in your life. Prospero Tree research finds that except for a couple of thousand rupees in lower taxes or lower expenditure on electronics, Budget is becoming increasingly irrelevant for the individual tax-payers.

The money spent on providing better services and better social security to the tax payer is minuscule. More and more money is being spent by the government on rural and semi-urban India - locations where individuals do not have taxable income. While helping the under-privileged is indeed a noble thing, the tax-paying Indian middle-class is increasingly left to fend for itself, be it for their employment, education, healthcare or housing needs.

However, there are certain benefits that are bestowed to taxpaying population in the form of deductions on investment, housing loans and most important but least appreciated exemption on long term capital gains. Investments in house and stocks is also an indirect way to profit from the boom in rural and semi-urban India that is being architectured by the government.

Budget - a Robinhood exercise for the tax-payer

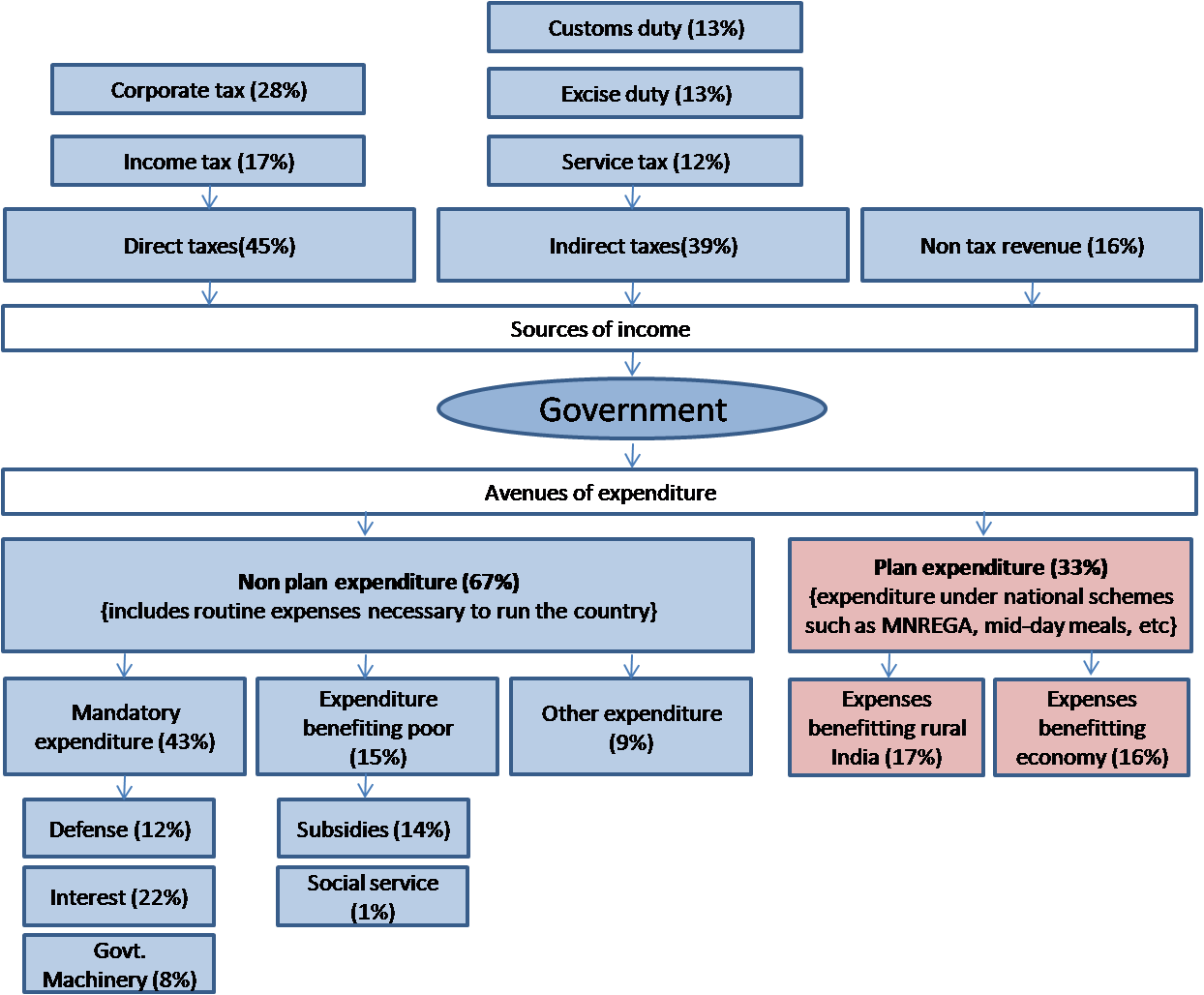

A simple look at the Government's revenue suggests that taxpaying individuals account for 17% of the total revenue. We note that of the 1200 million people in the country, there are less than 10 million taxpayers. Although everyone pays indirect taxes to the extent of their consumption of goods and service, the contribution of 10 million taxpayers remains significant. The middle class working population and businessmen form the largest chuck of the taxpaying population. The tax rates they pay are only slightly lesser than developed countries but they get little social benefits.

A detailed look at the expenditure patterns of the government reveals that rural and semi-urban India receives a disproportionate share on the non-mandatory expenditure. We define nonmandatory expenditure as all expenses other than one incurred on interest payments, defense and government machinery. Subsidies - food, fuel, agriculture loans, fertilizer, etc largely benefit farmers and rural population. Planned expenditure on health & family welfare, education, mid-day meals, rural development, largely benefit the underprivileged India as an average tax paying individual would always prefer to send their kids to private schools and visit private hospitals for their healthcare needs. Approximately 60% of non-mandatory expenditure is spent towards betterment of the non-tax payers.

| Individual tax payers contribution to government revenue | 0.17 |

| Direct government expenditure on tax payers | Negligible |

| Direct government expenditure on non tax payers | 0.32 |

It's a different story that a lot of money spent doesn't actually reach the non-tax payers as it is siphoned off. There is an electoral angle to this spending pattern too and any excessive spending by government results in excessive borrowing by the government, the interest burden of which is again born by the tax payers.

We re-iterate that spending on non-tax payers is not a bad thing at all. In fact, social equity is the greatest virtue for any society and efforts towards it are laudable. Only point we are highlighting is that there are only few ways in which tax payer can benefit from the Government's spending pattern. We are also cognizant of the fact that there are indirect benefits that tax payer enjoys - his career can grow as his employer reaps the benefit of rising rural incomes.

How to benefit from the Government's spending pattern?

Benefit 1: Take full advantage of investment and housing exemptions

There are a host of exemptions available under section 80C if you invest a portion of money in pre-designated products such as PPF, Insurance, ELSS, etc. Some of these instruments, especially PPF, offer the best tax adjusted returns in the country. In addition to 80C, there are deductions under HRA or for interest and principal repayment on your home loans. Investing in buying your own house is one of the best investments you can ever make - it gives you a lot of security and tax benefits too.

Benefit 2: Invest in stocks - the only source of unlimited tax free income

Long term capital gains tax on income from stocks and equity mutual funds is ZERO. This implies that irrespective of your tax slab, all your income from stocks held for more than a year is tax free. Imagine you earning a crore rupees and not paying any tax at all! No other asset class gives you this benefit. Of course, investing in stocks requires some expert advice but rewards can be substantial.

Benefit 3: Invest in stocks - the indirect way to benefit from India's rural story

The beneficiaries of Government spending have created what is called the rural consumption boom. The best way for the taxpaying individuals to benefit from this boom is to participate in it, either through his own business or through owning stocks of companies that benefit from this phenomenon. Companies such as TTK Prestige, Bata India, ITC, Butterfly, Manappuram, etc have benefitted immensely from the growing spending power in rural India and given solid returns to their shareholders.

Prospero Tree view

Government spending is increasingly directed towards rural and semi-urban India for the reason of equitable development as well as electoral strategy. The average tax-payer is increasingly left to fend for his own needs - social and financial. As such, they should utilize the limited benefits that Governments confer on them to the fullest. Investing in your own house and investing in stocks that benefit from the rural and semi-urban consumption boom could be a rewarding path for an average tax payer.