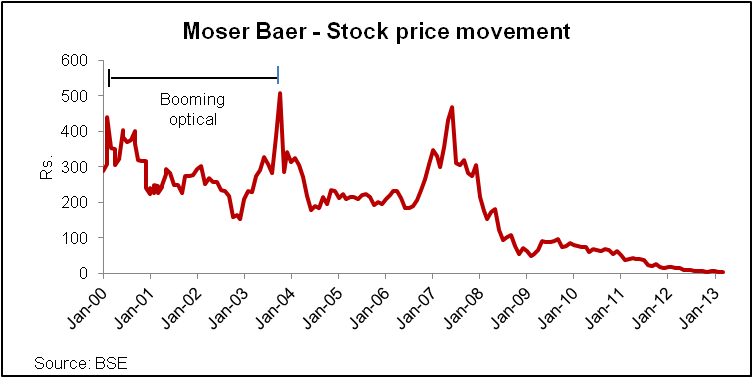

After a very promising start in 2000, Moser Baer had become the darling of investors and the top choice amongst consumers of optical storage media including CDs. The dream run came to a gradual halt over the next few years due to multiple reasons like competition, failed diversification and mounting debt leaving the investors in the lurch. A quick glance at the stock price chart below gives a whiff of the tumultuous time that beset the company.

2000-04: The Blue sky ride

The entrepreneurial vision of Deepak Puri, founder & CMD, Moser Baer forecast a stupendous global demand for optical storage media in late 1990s with the growing proliferation of personal computers. In1998, the company ventured into manufacturing of optical media storage devices - compact disks, magnetic disks & storage units.

In just four years, revenue skyrocketed from Rs. 154 cr in 2000 to Rs. 1500 cr in 2004 and Moser Baer went on to become the world's second-largest manufacturer of optical media, grabbing a 17% global market share with a presence in 82 countries.

2005: Reversal of fortunes begins, triple whammy hits Moser Baer

Softening demand Post 2004, the global demand shifted to flash memory and currently cloud computing, areas where Moser Baer had limited presence.

Reduced pricing power - As the demand for these products approached maturity stage in developed economies, the prices of CDs fell from $1.2 to 20 cents

Lowered cost of production Moser Baers main competitors, Ritek & CMC Corp of Taiwan moved manufacturing to China and significantly brought down the manufacturing cost. In response to this, Moser Baer ramped up its capacity in order to achieve economies of scale but failed to beat the Chinese low-cost advantage of its peers.

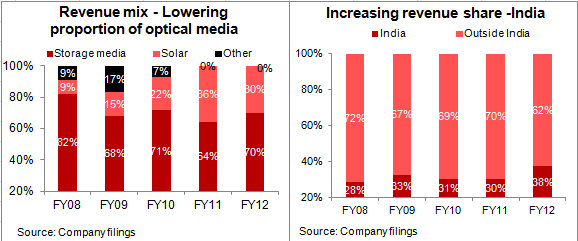

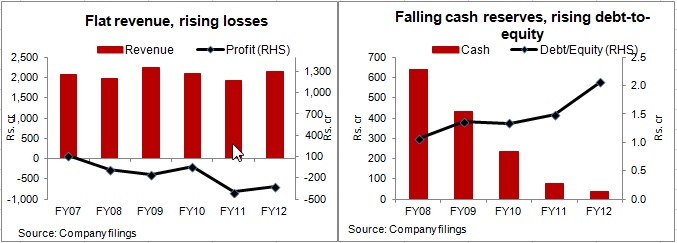

Shrinking revenue, rising inputs costs put pressure on its optical business margins EBITDA margins declined from 26% in 2008 to 16% in 2012.

Business diversification Solar products in FY06

In view of the changing market scenario, the Moser Baer management was compelled to de-risk its business and decided to diversify into solar products photovoltaic (PV) cells and solar modules. There was a global thrust on solar power and Govt. subsidies for it abounded. Moser Baer invested heavily in building its solar capabilities. It issued Foreign Currency Convertible Bonds (FCCB) in FY07 and raised $150 mio to finance its capex plans.

2008: Onset of gloom and doom

Sluggish throughput in solar business - The financial meltdown of 2008 led to a drastic slowdown in solar demand and a cutback in Govt. solar subsidies in Europe which constituted ~60% of solar panel global demand. The global photovoltaic industry remained challenged on account of huge over-capacity created by Chinese manufacturing resulting in significant price declines across the value chain. Moser Baer was again outdone by China in low-cost manufacturing.

Lack of traction in home entertainment business In 2006, Moser Baer had ventured into a related business home entertainment where it sold pre-recorded disks. It didn't achieve traction as currently it has no cash to purchase movie rights and piracy also poses a severe threat.

FCCB Crisis

FCCBs worth $88.5 mio were due for redemption in June12. Moser Baer was required to either redeem the bonds i.e. pay back the principal and interest accrued or the investors in the bonds could convert the debt to equity at a conversion price of Rs. 407 for 1st tranche and Rs. 364 for 2nd tranche of bonds issued. Since, the CMP of Moser Baer is Rs. 4.47 which is significantly lower than the conversion price of Rs. 407/364, the investors would want the company to payback the principal and interest accrued. However, the severe liquidity crunch forced the company to restructure its debt.

Stagnating revenues, mounting debt and cash crunch has let to severe losses since 2008. Its stock price has plummeted from the highs of Rs. 467 in 2007 to its CMP of Rs. 4.47

Continuous innovation remains the key for technology giants as they always face the risk of obsolescence. Also, China remains the low-cost hub for mass scale manufacturing and any company that wants to taste success in mass manufacturing will need to be mindful of those cost efficiencies in order to remain competitive.