The end of a golden journey

The last three days saw 15% fall in the prices of gold, India widely owned and highly revered asset class. From its peak rate of Rs. 3200/gram in November 2012, prices have fallen 22% to Rs. 2550/gram. A fall in a prices have significant impact on all sections of Indians the ladies would want to pre-pone their shopping, the men would want to buy it based on their belief that it will give them good returns in the long term. Lastly, investors in a host of companies like Titan,

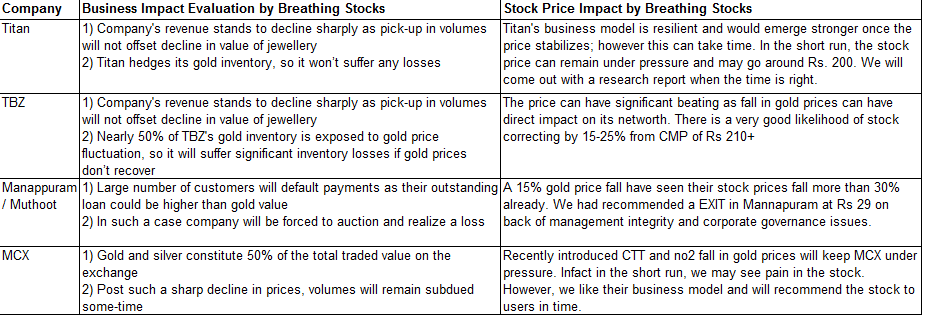

TBZ, MCX, Manappuram, Muthoot Finance, etc that have positive correlation to gold prices, could witness significant volatility in their holdings. We attempt to present an objective analysis of life after such a sharp gold price fall and the course of action that you should follow.

What led to the sharp gold price fall?

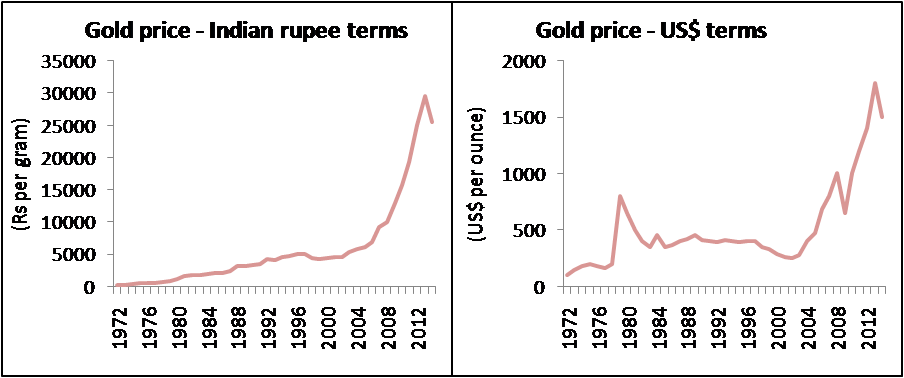

Gold has enjoyed the status of a safe haven for more than a century now. Multiple factors affect gold prices, but on a very long term, the only major function played by gold is that it has given protection against inflation. As such, returns on gold have roughly tracked global inflation over the very long term. There have been sharp medium term cycles after nearly rising four-fold between 1974 and 1979, it gave up 50% of its gains over the next two years and remained stagnant for over 20 years until 2005. Incidentally, these twenty years were the years of high growth and low inflation for US and Europe. Post 2005, gold prices rallied four-fold again in the period between 2007 and 2012 as global credit crisis unfolded and major currencies of the world depreciated as central banks printed more and more money. Indians have made even higher returns over last 30 years because the rupee has depreciated seven fold in comparison to the US$ from Rs. 8/$ to Rs. 55/$ over these thirty years.

The global economy has failed to recover meaningfully despite the monetary easing programs and is at the peril of sharp slowdown again. In case this happens, we will see long periods of demand destruction followed by very low inflation. This doesnt really augur well for gold and we believe there is a good likelihood of gold price stagnating in a narrow range for two to three years. The current fall is largely on account of the realization that global economy could be on its way to a sharp slowdown.

What should you do? Buy or wait on sidelines

As Indians, we are hard-wired to think that gold prices have no other option but to keep on rising. As explained in the previous section, in the very long term, gold will not give you super-normal returns, but it will protect you from inflation. As such you should not have more than 20% of your net-worth in gold. In-case you dont have significant exposure to gold, you can buy small quantity of gold at current prices and make your remaining purchases over next two years. Buy in large quantities only if there is a consumption need like wedding or gifting in the near term.

What is the impact of gold price decline on stocks?

In specific, there are a host of stocks that get impacted by the sharp fall in gold prices. Some of them are listed below:

Warren Buffet on gold

"Gold is a way of going long on fear, and it has been a pretty good way of going long on fear from time to time. But you really have to hope people become more afraid in a year or two years than they are now. And if they become more afraid you make money, if they become less afraid you lose money, but the gold itself doesn't produce anything."

Stocks, gold and now real estate?

The only other asset class that has such a strong positive bias as gold is real estate. Indians have made a majority of their fortune in real estate. Prices have increased three to four fold over the past four years. Is there an impending price collapse here too?