Why does Prospero Tree recommend you to read this article?

Over the last few years, private insurance companies have aggressively marketed Unit Linked Insurance Plans (ULPIs) with 'investments for future'Â being their unanimous marketing pitch. ULIP as a product category has a lower insurance component, complicated returns benchmarking and very high charges. The marketing pitch will focus on returns and money-back and lower tenure for payment of premium - all of which goes against the fundamental principal of insurance. This article aims at helping you understand why ULIPs should be the least preferred insurance product

- Understand the gamut of charges that you pay when you buy a ULIP

- Understand the impact of charges on the returns you earn

ULIPs - basic dynamics

The company deducts a mortality charge (based on your age and death cover) from the annual premium paid by you. This is in addition to a gamut of charges that the company deducts from your fund value/premium. The remaining amount aggregates in a fund in your name that may be invested in debt, equity, or a mix of both. The value of the fund is called Net Asset Value (NAV) and it varies every day. The NAV of the ULIP shall depend on the performance of these funds and the allocation of the investments to the funds.

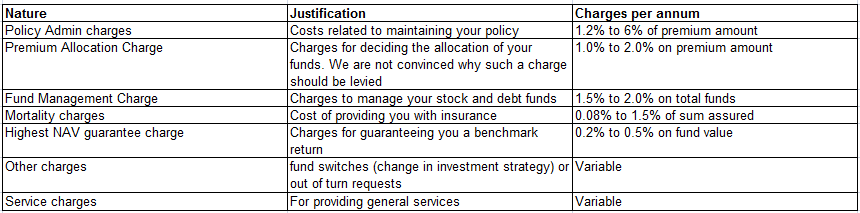

ULIPs - charges galore

As is clear from above, these charges can vary from 10% to 20 % of your premium for the initial few years. Most ULIP holders are not aware of the charges as they insurance provider does not explicitly charge from the customer. These are deducted before the investments are made. So if your annual premium is Rs. 50,000 only Rs. 44,000 accrues in your fund! Charges other than FMC and mortality decrease in the subsequent years (usually after 10 years) but it's quite late to make up for the initial handicap.

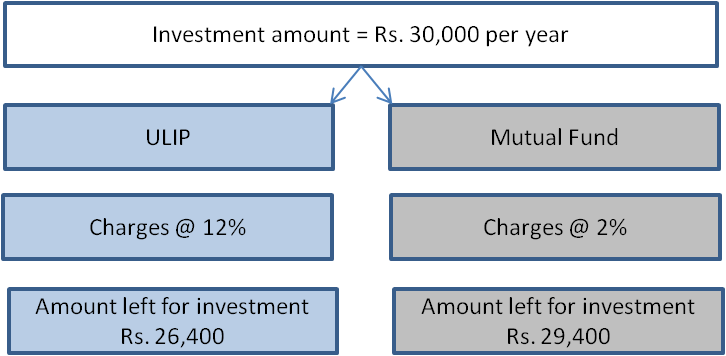

ULIPs - lower returns than a comparable mutual fund

As we have seen above, the host of charges levied by a ULIP plays a big role in depressing your overall returns. Assume that you are paying Rs. 100 per year as the premium towards your ULIP. After deducting the charges (on an average, they are around 12%), the corpus amount that is available for investments is Rs. 88. It's like running a 500 meter race with a negative handicap of 100 meters. For your corpus to regain its value (Rs100), it has to deliver 14% returns in that year. A mutual fund on the other hand charges a maximum of around 2% of the corpus value and hence is much less prone to the 'initial handicap'Â that ULIPs suffer from.(Read: Insurance -Â Wisdom in simplicity)

Prospero Tree view

At Prospero Tree, we are of the opinion that high charges and lower sum assured in most ULIPs defeat the primary objective of insurance. It is always a good idea to buy a term insurance and a mutual fund instead of ULIP or a term insurance and PPF instead of endowment plan. Given the complications in calculating returns in a ULIP, most people believe what the salesman has to say and end up paying too many charges. In our next article, we show you exactly by how much are you better off buying a combination of term insurance and a mutual fund vs. a ULIP.