Why does Prospero Tree recommend you to read this article?

At Prospero Tree, its our endeavor to simplify decision making through objective research. Insurance is one of the basic needs to tackle life uncertainties but ranks among the most mis-sold financial product. Given the variability in the expected returns, covers, gamut of charges and the options available, we have observed that people often buy what is being sold rather than what they need. The needs are simple, but the insurers complicate them to sell their products. This article aims at helping you understand the following

- Which product suits your insurance need

- Why is insurance a sub-optimal way to save and invest

Insurance - Which product should you buy

India insurance landscape is as diverse as its population there are 24 life insurers in the country each offering multiple variants of term insurance, endowment plans, and ULIPs. Term insurance is the least marketed product while ULIP (of late, even traditional plans and single premium plans) is the most aggressively publicized product for obvious reasons higher the premiums, higher are the charges that the insurer can deduct. Keeping all the noise aside, we re-visit the primary principals of insurance and opine that the most crucial parameters in deciding which kind of product to buy are the value of sum assured and tenure of the insurance

Criterion 1: Have adequate sum assured

Given the increasing standards of living coupled with rising inflation, a person in his late 20 or early 30 should at least have a sum assured (on untimely death) of Rs 25,00,000 (thumb rule says 10 times your annual income is appropriate). The amount may seem excessive today but you should remember that the value of Rs. 25,00,000 after 10 or 15 or 20 years will be much lower than it is today! And insurance is all about planning for a calamity at the next stage of your life.

The premium amount for a typical term plan that gives you a sum assured of Rs 25,00,000 will be Rs. 8,000 per annum (still lesser for online term policies). In contrast, an endowment plan or a ULIP giving you a similar sum assured will have a premium amount of Rs. 100,000-Rs 150,000 per annum. Our survey suggests that a majority of the young generation will find Rs. 100,000 per annum as prohibitive, they opt for endowment plans and ULIPs with a lower sum assured or Rs. 500,000 or Rs. 10,00,000. In all likelihood, Rs. 500,000 will help your family pay only 12 monthly bills after 10 years! So remember, you need MORE sum assured.

Suppose you are not in a position to shell out more than Rs. 30,000 per annum for insurance, a much better option would be to take a term plan with sum assured of Rs. 25,00,000 and annual premium payment of Rs. 8,000. This leaves you with additional Rs. 22,000 which you can invest in PPF or mutual fund, depending on your overall investment objectives. The next section shows that the above-mentioned combination of term plan and the mutual fund will give you better returns compared to a ULIP.

Criterion 2: Choose a policy that will insure you for a longer period

Risks to life increase with progressing age and this are well reflected in the premiums charged for a 30yr old vs. 45yr old. A quick illustration would be a simple term plan that gives you a sum assured of Rs. 25,00,000. The annual premium for a 30yr old would be Rs. 8,000 which for a 45yr old would be upwards of Rs 20,000. Thus you should make sure that the policy you buy covers you till the age of 55 years at least. Some ULIPs like HDFC Crest cover you only for 10 years! Imagine the cost of buying a new insurance policy when your age progresses by 10 years.

Insurance a sub-optimal way to invest

Just as sum assured in case of death is the most critical aspect of insurance, absolute returns are central to the idea of investing. In case you still hold the opinion that insurance is a good investment vehicle, we try to decipher the complex return structures of ULIPs. This complexity arises from the fact that a gamut of charges is deducted from your premium amount and the returns on you corpus are subject to vagaries of debt and equity markets. While < Insurance Innovation and complexities> highlights the impact of charges your corpus, the table below illustrates the variability on corpus performance.

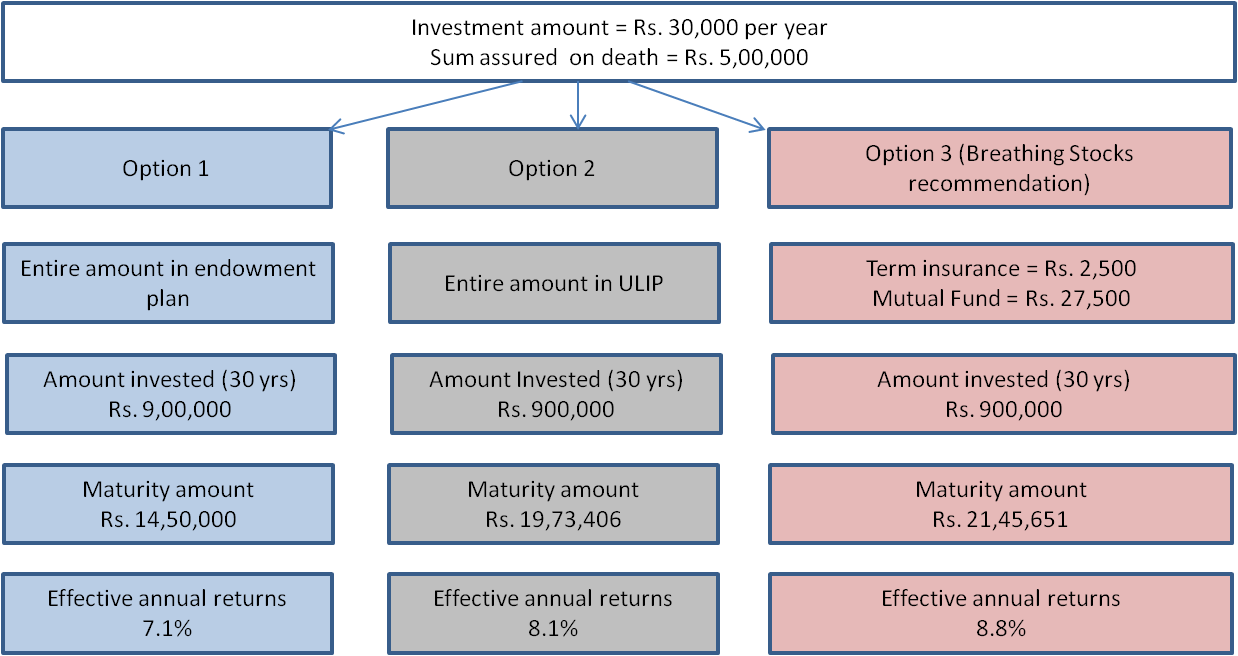

To try and understand the payoffs of each of these policies we have taken popular policies in each of the product types. The assumptions are also enlisted at the end of the article. The calculations show that a combination of mutual fund and term insurance gives better returns on investment (ROI) compared to ULIP. An even better option would be to go for direct equity investment, in case you have a good equity advisor.

Prospero Tree view

At Prospero Tree, we believe that understanding a financial product is the key to maximizing the returns from it. Insurance is a classic example of a simple product transformed into an exotic product by its originators, thus clouding the decision making process for a common man. Our vociferous recommendation to any insurance buyer would be to go for a high 'sum assured' and long tenure. Also, it is generally not a good idea to combine insurance with investments (ULIPs). You get the best of insurance and investments when you opt for two separate products - term insurance and mutual fund. This will save you from a host of charges, ensure better returns and most importantly, allow you have afford a adequate sum assured in case of death.

Is it better to buy insurance from LIC vs. the private players?

LIC is a behemoth in the business, and all the policies are backed by the Government of India (GOI). In addition, the claims ratio is more than 98% as compared to private insurers whose claim ratios are between 85-95%. Claim ratio means the probability that your nominee claim is approved. This is an important ratio as you would want higher assurance that after you, your nominee gets the death benefit that is his right.

List of some popular term plans

- LIC Anmol/Amulya Jeevan

- ICICI Pru iCare

- Bajaj Allianz New Risk Care

- HDFC Click to Protect

See our other articles on Insurance innovation, related mis-selling and the best fit for you:

1. Insurance Innovation and complexities

2. ULIPs Low on insurance, high on charges

Appendix - General Assumptions

- All indicative amounts in INR, policies for a 25 year old male

- Sum Assured: 500,000; Tenor: 25 years

- Discounting Rate: 8%

ULIPs

- Equity returns - 10% per annum, Debt returns - 7% per annum

- Debt: Equity - 35:65

- We opt for capital protection (charges of 0.25-0.5% of the fund value per annum)

- Fund Management Charge: 1.35% -1.75% per annum for fund allocation

- Miscellaneous charges: INR 500 per annum

- Premium Allocation charges: 4% for year 1, 2, 3% for year 3 and 2% for years 4,5

- Policy Admin charges: 0.31% of annual premium increasing by 5% annually (max 0.46%).

Endowment Plans

- Loyalty Additions:2% of sum assured p.a. from year 11

- Guaranteed Additions: 4% of sum assured

- With profits: 1% of sum assured p.a. from year 11

- Return of premium from fourth year