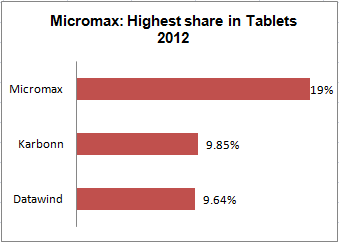

The advent of golden age of Indian telecom industry in 2003 saw mobile phones becoming ubiquitous and translating from being a ‘luxury’ to a ‘quintessential need’. Nokia emerged as the undisputed leading mobile handset maker followed by Samsung and Micromax – the home grown giant.

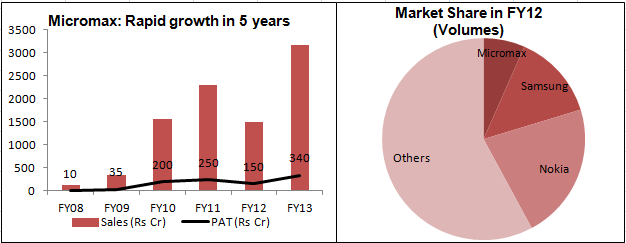

Since its inception in 1991, Micromax has come a long way from being an IT peripheral player to becoming the 3rd and 12th largest mobile handset seller (by volumes) in India and globally respectively. Its foray in the mobile handset business in 2008 saw its revenue increase at a whopping rate of 72% CAGR from Rs. 120 crore in FY08 to Rs. 3168 cr in FY13.

Micromax’s success story is an outcome of its focus on providing features phones at affordable prices supported by an unmatched distribution network across India. For instance, the Dual Sim feature phone was an instant success with the business community whereas the 30-day battery life phones saw phenomenal success from areas with limited access to electricity. Micromax mobile phones are priced at a very attractive range of Rs. 2,000 to Rs. 10,000 against premium pricing adopted by global behemoths. It leveraged its unmatched pan-India three-tier distribution network consisting of state-level distributors (60+), local distributors (800+) and retail outlets (50,000+) spanning across almost all the States in the country, including Tier-2 and Tier-3 towns.

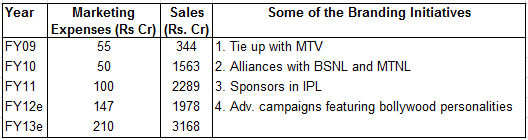

Currently, Micromax is positioning itself as an affordable smartphone provider and expanding its reach to other Asian countries. Within India, Micromax is already among the top 3 players in smartphones category and is giving a serious competition to premium mobile phone manufacturers like Samsung & Apple. It has also established itself as a market leader in the ‘Tablet’ category and has become extremely popular across India.

Micromax: The birth of an indigenous giant

Micromax was founded by Mr. Rajesh Agarwal in 1991 and he was joined by three other friends – Rahul Sharma, Sumeet Kumar and Vikas Jain in 1999. From being an IT peripherals distributor, the company decided to diversify into mobile handsets market in India in 2008. As a new entrant in this space, the promoters were guided by the philosophy of providing new features and creating niche categories not catered to by competitors.

Focusing on core competencies

Micromax focused on its core competencies of product development, design and marketing by having in-house teams. However, the manufacturing was outsourced to factories in China & Taiwan to keep the costs low thereby turning Micromax into an asset-light model. For instance, though its sales increased 13 times between FY08 and FY10 to Rs. 1563 cr, its fixed assets barely doubled to Rs. 11 cr. Another noteworthy benefit accrues from near zero working capital requirements as it does not offer any credit to its distributors. The company maintained a negative working capital of Rs. -47 cr in FY10 on sales of Rs. 1563 cr.

Aggressive mainstream marketing

Advertising and brand management have had a big share in the success and popularity of Micromax. Over the years, Micromax has spent 5-7% of its sales in marketing and brand building which is higher than some of the FMCG majors.

Foray into Manufacturing - A mistake?

In FY10, Micromax decided to invest Rs. 250 crore to set up its own manufacturing unit in Baddi, Himachal Pradesh to ensure that its outsourcing model does not cause supply-side uncertainties. The plant when fully operational will be able to produce upto 10 Lakhs handsets every month. However, it is yet to be seen if a capex heavy route will augur well for

Micromax.

Tough Times lie Ahead

Feature phones were the hallmark of Micromax’s initial success. With shifting consumer preference towards smartphones, Micromax introduced low-budget smartphones well in time and witnessed a stunning 60% increase in sales to Rs. 3168 cr in FY13. The mobile handset market is poised to maintain its growth momentum on the back of increasing handset replacement demand. But this industry is witnessing an ever increasing competition where market share can swing very fast. We have a classic example of Nokia losing its dominant position in India over a very short time.

Micromax's value proposition is about selling affordable phones to mass market but competition in the same segment is increasing at a much faster rate with many large players introducing phones under Rs 10,000 mark. Samsung has emerged to be the flavor of the Indian handset market while Nokia has lost its sheen. Uptil now, Micromax seems to have got its success formula right but will it trounce Samsung to attain the numer uno position? This remains to be seen as in the technology space, market shares change very rapidly in tandem with innovation and consumer preferences.