Aviation industry is a classic corroboration of the fact that not all technological innovations result in great financial gains. In 2012, global aviation industry clocked revenues of US$631bn while profits languished at US$3bn indicating that most of the players registered losses. A lot of times, lessons from history are often ignored and India liquor baron, Mr Vijay Mallya was not exception to it. Lured by the surging air traffic in India, he started Kingfisher Airlines in 2003. Despite having few firsts to its credit such as reaching the million passengers mark in four years of operation and achieving the highest market share, it posted losses in every single of year of its commercial operations since 2005.

While lot of Kingfisher problems are well known in the public domain, we at Prospero Tree have tried to filter the noise surrounding it and present a simplified analysis of why it failed. The culprits are familiar acquisition of Air Deccan to propel faster growth, excessive debt to finance the acquisition and inability to synergise operations. Rising fuel costs and taxes have surely impacted, but its impact is secondary and players such as Jet, Indigo and Spicejet, who have streamlined operations, have been able to tackle them.

The big-bang start & the fatal acquisition

The airline started its commercial operations in May 2005 with a fleet of four new Airbus A320-200s and focus on quality in-flight services like in-flight entertainment (IFE) system with personal TV, seats with full flatbed/high degree of recline, blankets, meals, headphones, chargers and not to forget the polite air hostesses which added to the WOW experience. Customers vouched for the quality services and passenger traffic for Kingfisher continued to surge. All the while, it continued to make financial losses.

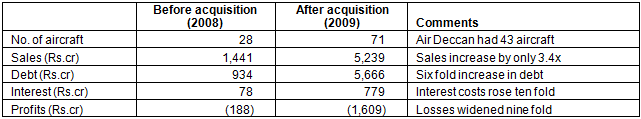

In its bid to start international operations, Kingfisher acquired Air Deccan in April 2008. The aviation regulations allow international operations only once an airline has completed five years of commercial operations and Air Deccan fitted the bill. It was acquired at the valuation of Rs22bn and rechristened as Simplifly Deccan and later on as Kingfisher Red. Below are the changes that happened between FY08 and FY09.

What went wrong?

Trouble started brewing for Kingfisher Airlines post the acquisition of Air Deccan. While some of it was external in nature, a large part of it was internal and was directly or indirectly related to excessive debt. Global credit crisis and the resulting decline in air traffic was a major set-back initially, but worked in favour of airlines later on as they benefitted from lower fuel costs in 2009-10. Let us look at the important internal factors in a little more in detail.

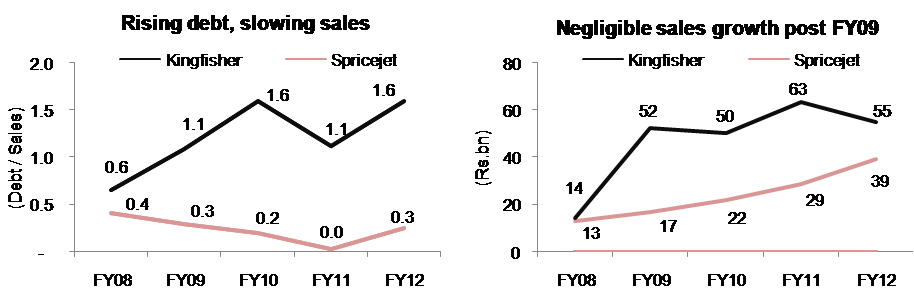

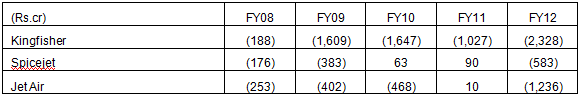

Rising debt: Interest costs skyrocketed as debt jumped from Rs9.4bn in 2007 to Rs79.6bn in 2009. However sales growth failed to catch up post the acquisition due to 1) failed positioning of low cost airline, and 2) high losses leaving little room for the Kingfisher Management to experiment or spend money on marketing. Compared to this, Spicejet saw a steady increase in sales and its debt burden remained manageable.

Confused positioning: By entering the low cost market through acquisition of Air Deccan and re-christening it as Kingfisher Red, it ended up creating confusion about the brand. The original luxury carrier, which had better margins, started witnessing lower passenger traffic and sales growth continued to lag expectations. Slow sales growth is a disaster for any company with high debt and this is what transpired for Kingfisher Airlines.

Credit crisis and rising fuel costs: Power & fuel cost account for ~40% of the total operating costs for our domestic carriers. From early 2010, fuel prices rose more than 40%. Moreover in mid-2011, oil prices fell to a low of $100 a barrel but Kingfisher couldn't capitalize on it owing to lack of synergies post merger and high interest cost.

Unfavourable fuel policies in India: Fuel costs for Indian airlines are higher vis-a-vis global peers as the India fuel taxation system includes central excise duty of 8.2% and sales tax levied by state governments which varies from 4% to 30%. Due to this, fuel costs account for approximately 30-45% of total operating costs for Full-Service Carrier (FSC) & 40-55% for Low-cost carriers (LCCs) which compares unfavorably with a global average of 33%.

What lies ahead?

The debt problems exacerbated into non-payment of salaries to employees, service tax, airport authority charges, etc. In response, there were multiple strikes by employees which resulted in frequent flight cancellations and complete erosion of customer trust. It had to scale down its operations from 63 to 16 aircrafts, and attracting equity investors in such a vulnerable state became impossible. In February 2013, airline lost all international and domestic flying slots. Consortium of lenders led by SBI has started to recover the loans by selling Kingfisher Assets worth Rs10bn.

There is little hope of recovery even after the sale of promoter stake in United Spirits to Diageo. The recent currency depreciation has ensured that fuel costs in India are at an ALL TIME HIGH and there is an increased likelihood of interest rates remaining at elevated levels. This casts a shadow not only on the possibility of revival of Kingfisher, but also on the financial health of all the established players.

Prospero Tree View

Most Indian airlines have failed to generate profits in the last seven years. One may ponder that why would an entrepreneur start and run such business where only a few airlines in the world have been successful. Indigo, Virgin, Southwest are few such names and most countries will have only one profitable airline.

We believe that most of these airlines owner operate on a lot of debt and the promoters have little stake in the company. Thus, incentives for making profits are miniscule. The promoters are well aware that aviation is an important sector for the economy and banks would offer easy loans and bail-outs time and again. The only real loser in such a situation is the minority shareholder and you are always better off not investing in this sector.