Rural Electrification Corporation (REC) is one of the key financiers to Indias power sector and operates in the areas of transmission, distribution, generation and renewable energy space. Lending is largely towards India public sector power utilities at the central, state and private sector power utilities. It was established in 1969 for the purpose of developing the power infrastructure in rural areas and since then, has diversified in to financing all segments of the power sector, including generation, transmission and distribution. REC is one of only 14 Indian public sector undertakings to be granted Navratna status.

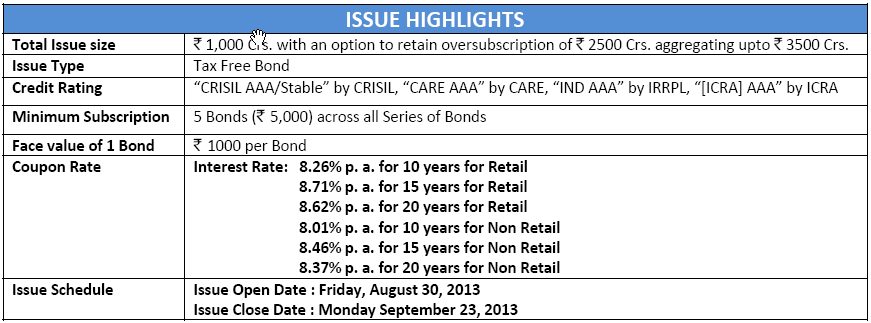

NCD details

Objects of the issue

The Company is authorized to raise Bonds aggregating up to Rs50bn in one or more tranches in FY14. The issue is a part of the annual fund raising exercise and the proceeds will be used to lend to the power sector projects in the central, state and private sector.

Business fundamentals of issuer

REC has a networth of Rs181bn as on Jun 2013 and has borrowings to the tune of Rs1111bn, which translates to a pre-issue debt to equity ratio of 6.1x. These leverage ratios are far lower than permissible limits of 11x and provide reasonable margin of safety.

Credit worthiness

ICRA, CARE and CRISIL ratings have assigned AAA/Stable rating to the long term borrowing program of the Company aggregating to Rs345bn, implying the highest degree of safety regarding timely servicing of financial obligations. We also note that Government of India is the majority shareholder in the company and the issue carries an implicit government guarantee.

Yield attractiveness

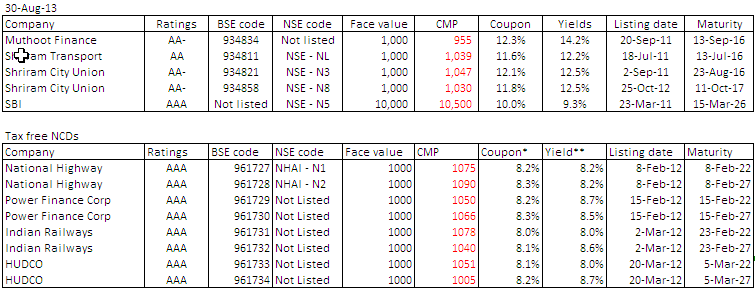

The REC tax free bonds offer 8.7% for the series with 15 year maturity, which is similar to the yields offered by PFC, IRFC or HUDCO tax-free bonds that were issued last year (table below). For investors in the 30% tax bracket, the pre-tax equivalent yields for the REC bond works out to 12.4%, which is higher than any kind of bank fixed deposit. In fact, the post tax returns are higher even when compared to the public provident fund (PPF) post-tax returns of 8%

**Yields as on 30th Aug 2013

**Yields as on 30th Aug 2013

Liquidity expectations

Although these bonds have maturity period of 10 to 15 years, investors can sell them on the stock exchanges from day one of listing. However, investors must make a note of the fact that liquidity on stock exchanges can be low, especially after six to twelve months of listing and liquidating huge amounts (over 10000 bonds) can result in minor price erosion. Liquidity is generally benign around the interest payment dates and investors with large positions should buy / sell around that time with little impact cost.

Prospero Tree Recommendation

The yields offered by the REC tax-free NCDs are similar to those offered by other government institutions like PFC, IRFC, and HUDCO. Thus investors can either subscribe to this issue or buy the other listed tax-free NCDs (15-year) from the secondary market. The only advantage in subscribing to the issue vs. buying it from open market is that you save ~2% of the NCD value due to absence of brokerage & impact cost.

Tax-free bonds as a fixed income instrument is extremely attractive for investors in the 20%-30% tax bracket as it gives them an opportunity to earn post-tax yields of 8% for 10-15 years. So those taxpayers who have a lot of money in fixed deposits should switch to these NCDs for substantially better returns.

Interest rate cycle has reversed for the worse, contrary to our expectations of gradual decline in interest rates. The currency depreciation has resulted in tight liquidity, which in turn has resulted in rising interest rates again. Although we believe that these elevated interest rates will continue for some time and there will be little gains in the form of capital appreciation, the long term tax free yields of +8% are very attractive.