Stocks of Essar Oil, Astra Zeneca and Fulford India had been recently buzzing with delisting news. This would have certainly evoked investor interest in these stocks; but before jumping to buy/ sell/ hold decisions on these stocks, it's important to understand the nityy-gritties of delisting to enable you to take informed investment decisions.

Why do companies delist?

Delisting is the permanent removal of securities of a listed company from a stock exchange. A delisted stock can no longer be traded. This delisting can be a compulsory or voluntary delisting.

1. Compulsory delisting

SEBI directs the company to delist due to non-compliance or violation of listing requirements. In this case, the shareholders are left with no choice but to tender their shares for the delisting.

2. Voluntary delisting

Companies may decide to voluntarily delist for any of the below reasons.

- The cost of compliance may outweigh the benefits that accrue due to listing. For instance, MNCs in India got listed back in the 1970s as the then regulation capped foreign ownership at 40%. But now, with liberal FDI caps in several sectors combined with increasing complexity of regulations and disclosures, numerous MNCs have already chosen or are planning to delist from the Indian bourses.

- The need for greater operational and financial flexibility to support a companys business and strategic needs may warrant a higher promoter stake and delisting. Essar Oil has cited this as a reason for its delisting plans.

- Negligible or absence of trading, closure of business, merger or takeover could also be some of the reasons for voluntary delisting.

- Successful delisting in India - A costly affair

Delisting in India is a costly affair for the promoters. The exit price is discovered through a Reverse Book Building (RBB) process where shareholders bid. There is no upper cap on this price but promoters can decline the price discovered through RBB. Some shareholders with vested interests can demand unfair price and bid at very high prices. Hence, delisting in India takes place at a significant premium to its market value. As an illustration, Astra Zeneca tried to delist for the first time in 2004. Discovered price through RBB was Rs. 3,000 when its CMP then was Rs. 900.

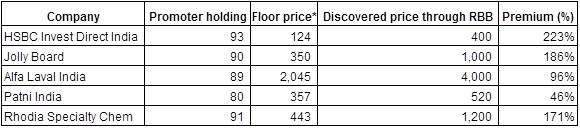

Premium exit prices discovered through Reverse Book Building (RBB) process

Source: Company filings, Prospero Tree research

*Floor price: Minimum price which is average stock price 6 months preceding date of delisting announcement

How do companies sidestep delisting norms?

A company can delist if below two criteria are fulfilled:

1.At least 67% of public shareholders should vote in favor of the deal

2.Pos-offer shareholding of promoter reaches higher of

- 90% of total issued capital

- Aggregate % of pre-offer promoter shareholding and 50% of offer size

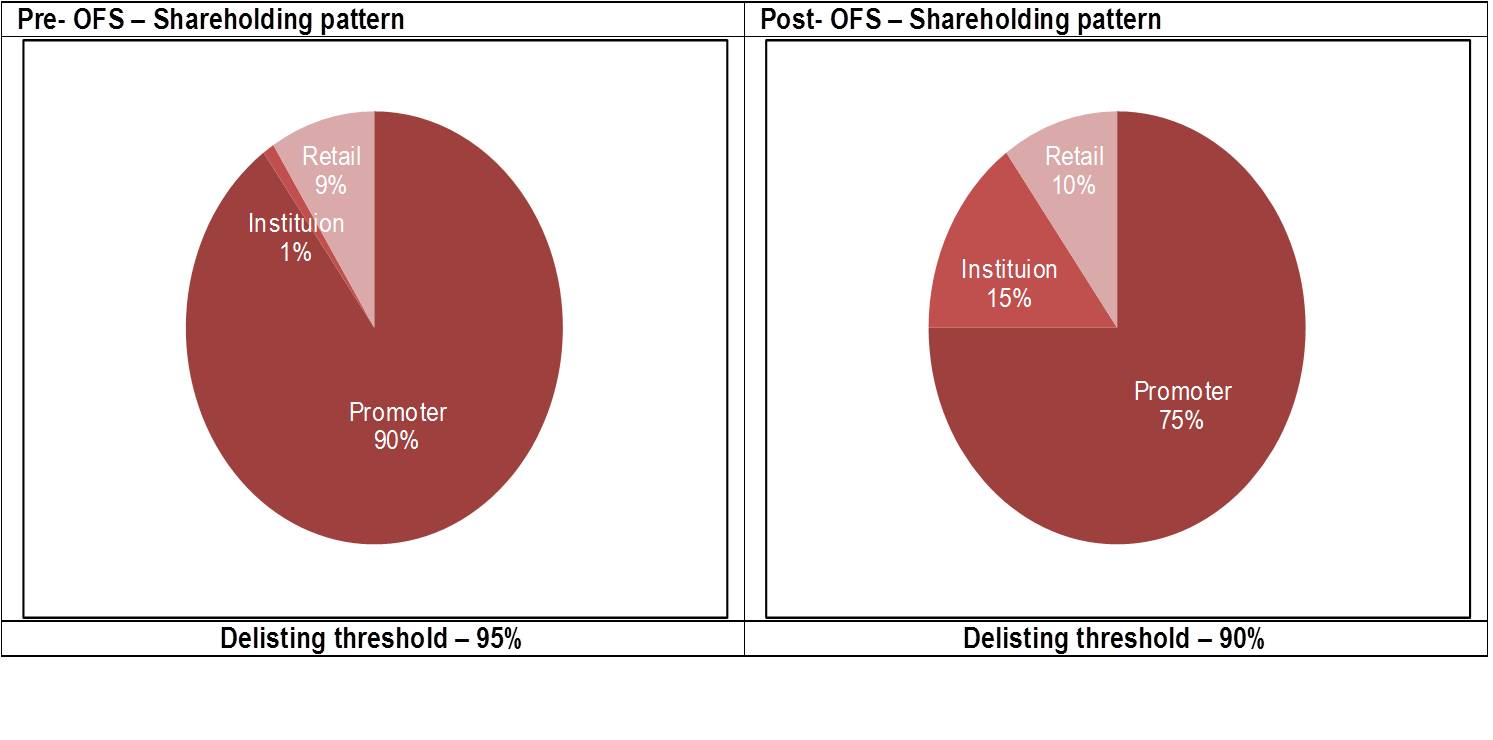

Companies seem to be using Offer for Sale (OFS) and Institutional Placement Program (IPP) to facilitate delisting. A case in point is Astra Zeneca - it announced its OFS in April, 2013 and re-announced delisting plans in March, 2014. In the OFS, it sold its stake to 6 FIIs which in our view is just a tacit understanding with these friendly FIIs who will support delisting at a reasonable price when the time comes. As can be seen from the below exhibit, the delisting threshold came down from 95% to 90% post-OFS. This 90% threshold could be relatively easily achieved with a 75% promoter stake and 15% institutional stake.

Astra Zeneca - Fulfilling delisting norms post-Offer for Sale (OFS)

Source: Company filings, Prospero Tree research

Source: Company filings, Prospero Tree research

This practice is quite well-established and well-known to the regulators as well. Clearly, SEBI needs to fix this loophole. But, until then, minority shareholders need to be cognizant of this dubious practice and take investment decisions accordingly. Do watch out for the second part of this series which will talk about specific course of action for an investor when a company announces delisting plans.

Also, checkout our Investment articles on Essar Oil Delisting Arbitrage Idea. For this you will have to sign-up on our website.