A secular growth story riding on the housing wave

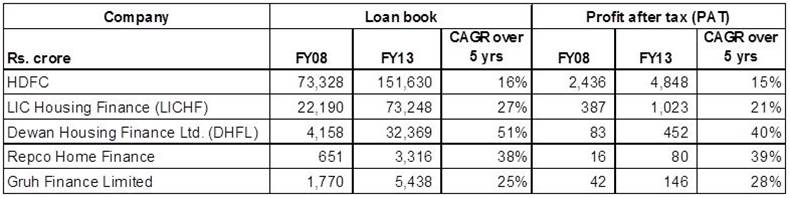

The housing finance companies (HFCs) like LIC Housing Finance (LICHF), Dewan Housing Finance Ltd. (DHFL), Repco Housing Finance and Gruh Finance Ltd. have clocked exceptional CAGR of 25%+ in both loan book and profits over 5 years period. Small HFCs like Repco and GRUH have successfully created a niche for themselves with their unique business models and have generated superior operating and profitability ratios.

Financial snapshot of HFCs - Loan book and PAT

Source: Company filings, Prospero Tree research

Source: Company filings, Prospero Tree research

Stocks of some niche HFCs have delivered scintillating returns.

- Repco Housing Finance - It has delivered a stellar 145% return over a 15 month period since it got listed. We had recommended subscription to its IPO Click here to read our full article

- GRUH Finance Ltd. - It has delivered ~60% returns over the last 12 months.

Multiple long-term drivers will continue to fuel housing demand

The housing finance segment is poised to register 20%+ CAGR on the back of mortgage under-penetration in India, increasing aspirations, affordability, urbanization, nuclearization of families and unmet demand from the affordable housing segment.

Niche HFCs - An opportunity for investors

Banks and HFCs are the key players in the housing finance space but since 2007, the market share of HFCs has steadily increased from 32% to 43%.

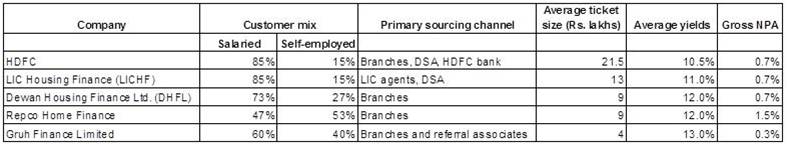

- Key differentiators of niche HFCs - Low income group, self-employed target segment & innovative product: Â Banks like SBI, Union bank, ICICI and large HFCs like HDFC and LICHF have largely remained focused on the salaried segment in metros and urban areas while smaller HFCs like Repco & Gruh have targeted the underserved self-employed segment, a relatively riskier segment, in hinterlands.It's easier to assess the repayment capabilities of salaried segment as they have regular cash flows. Niche HFCs will continue to charge higher interest rates vs. banks & large HFCs as the self-employed customers in hinterlands are willing to pay a premium for innovative product offerings, quick turnaround time and service delivery.

Banks vs. HFCs - Key differentiators

Source: Company filings, Prospero Tree research

- Robust operating model - Low operating costs and healthy asset quality:Â The lean branch model coupled with an optimized employee base keeps operating costs under check. Unlike banks, niche HFCs do not outsource field verification, legal and valuation checks and the same employee is responsible for a gamut of activities sourcing, credit appraisal, documentation, monitoring and collections. The installment-to-income(IIR) and loan-to-value (LTV) ratios are capped at 50% and 70% respectively, much lower than those of banks and large HFCs. This entire eco-system ensures a tight control on operating costs and asset quality.

Prospero Tree view - Opportunities for investors

We remain bullish on this segment and expect the growth and earnings momentum to continue given the huge Rs. 11 trillion market size of the small ticket (Rs. 3-10 lakhs) housing space and the Govt's thrust on affordable housing. Particularly, niche HFCs could continue to disproportionately benefit from benign regulations vis-vis banks relatively low capital requirements, low provisioning and low-cost funding support from NHB.

Repco Home Finance and Gruh Finance Ltd. are the two stocks that have been on our radar for a plethora of reasons - 25%+ loan book CAGR in last 4 years, increasing geographic penetration, solid understanding of local markets, sub 20% cost-to-income ratios, healthy asset quality, and superior return ratios. Watch out for our stock recommendations in the Investing section.