It's said that time doesn't stop ticking, but for HMT Watches Ltd., time will stop ticking as the Board for Reconstruction of Public Sector Enterprises has recommended the closure of HMT Watches Ltd. & HMT Chinar Watches, both subsidiaries of the HMT Group. While in today's times, Titan, Fossil, Kenneth Cole, Gucci, Tag Heuer, Guess, Rado and other international brands may be the flavor of the season, but over 4 decades ago, HMT Watches Ltd. was the undisputed market leader in this category. We will retrace HMT's journey from its meteoric rise to its inevitable fall. This story will also help investors to identify quality businesses separating wheat from the chaff.

1961-1981: Golden era backed by Govt stringent import policies

HMT Watches was set up in 1961 in collaboration with Japan's Citizen Watch. The company was a key beneficiary of the then Govt. policy which imposed severe restrictions on imports thereby thwarting any meaningful competition. This resulted in a monopoly-like market with Timestar watches as the only other significant competitor. HMT watches commanded the number 1 position with its market share having touched 90% as well for brief periods.

1981-1991: On slippery grounds - HMT's launch of quartz watches bombs; Titan enters the fray

Circa 1981, the global watches market transitioned from mechanical watches to quartz watches. HMT also followed suit and launched quartz watches in India. However, it didn't witness a huge demand offtake as the Indian consumers found the quartz watches expensive. Followed by the debacle of quartz watches, HMT's management made a strategic decision to focus solely on mechanical watches and thus ramped up the production capacities of mechanical watches. The year 1981 marked the entry of yet another watch company - Hyderabad Allwyn Ltd., a PSU, in collaboration with Seiko, a Japanese company. In mid 1980s, as the hitherto import restrictions were lifted, prices of quartz watches declined; Titan also entered the Indian market in 1985 with a "quartz-watches-only" strategy while HMT continued to focus solely on mechanical watches. All this put HMT on a sticky wicket which exacerbated in the years to come.

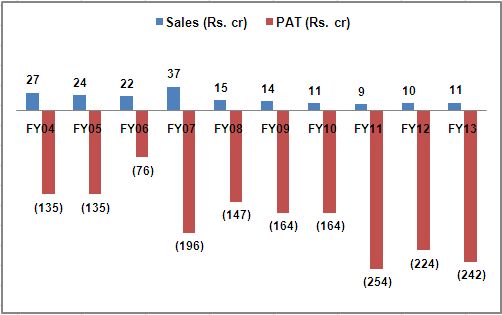

Post 1991: The dawn of free fall - Plummeting sales, mounting losses

The competition intensified as the historic 1991 liberalization opened the doors for international watch brands as well. As quartz watches became the norm in India, HMT too launched quartz watches across price points to remain relevant. In 1991, HMT reached its pinnacle it clocked its highest ever sales of Rs. 300 crores. But then, its downhill journey began as can be seen from the below exhibit. In 1994, HMT registers a Rs. 60 crore loss while Titan records Rs. 19 crores profit.

HMT: Plummeting Sales, Mounting Losses

Source: Company filings

Source: Company filings

Prospero Tree View

The hallmarks of an excellent consumer business are ability to change rapidly with changing consumer preferences, innovation, creating & riding on trends, branding, creative marketing and distribution. Titan, the 'watches-to-jewellery-to-eyewear' specialty retailer completely transformed the competitive landscape of watches by launching attractive designs across price points for different age groups, branding, marketing, positioning watches as a quintessential accessory and developing an unrivalled distribution network in metros and tier 2 & tier 2 towns. Titan foresaw the unlocked demand potential with rising urbanization, aspiration and growing incomes and scripted its success with the execution of its strategy. HMT, the erstwhile watches behemoth failed on all these counts and has today been reduced to a shadow of its former self. At Prospero Tree, it's our constant endeavor to help investors identify good and quality businesses to invest in. Visit our Investing‚ section to read our various stock recommendations.