VIP Industries, India's largest luggage manufacturer with ~50%+ market share and Asia's second largest player, has witnessed a tepid growth in last 2 years owing to subdued consumer sentiment, inflation, lower discretionary spends and slowdown in one of its key drivers - air traffic. Apart from the headwinds in the macro environment, competition, too has gathered steam in the luggage market in Indiab - Samsonite, VIP's only formidable competitor in the organized market, is also aggressively expanding in this geography and has managed to make inroads in VIP's turf. This story talks about VIP's efforts at rejuvenating its business by revamping its product mix, launching new brands, entering new categories and paring debt.

| VIP “Financial Snapshot" | FY08 | FY09 | FY10 | FY11 | FY12 | FY13 | FY14 |

| Sales (Rs. cr) | 556 | 532 | 637 | 744 | 862 | 877 | 975 |

| Sales Growth (%) | - | -4% | 20% | 17% | 16% | 2% | 11% |

| EBITDA (%) | 10.8% | 8.7% | 15.1% | 16.8% | 13.9% | 8.0% | 8.6% |

| Working Capital as % of Sales | 25% | 24% | 21% | 29% | 24% | 20% | 17% |

| Debt / Equity (%) | 98% | 98% | 51% | 53% | 35% | 16% | 6% |

A. Sharpening Product Arsenal to Revive Growth

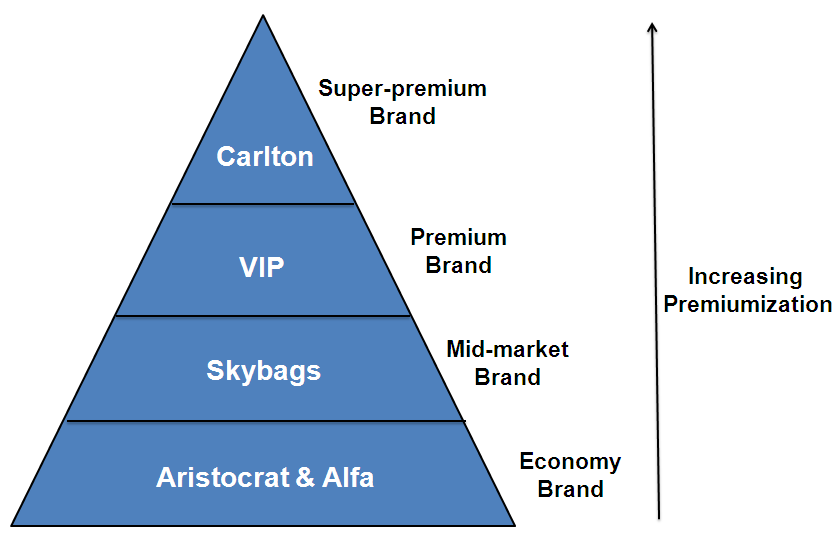

Launch of new brands across price points: In a bid to capture a wider customer base, VIP has periodically launched new brands across price points (as evident from the below brand pyramid). In the mid-market segment, VIP launched 'Skybags' in 2010 in response to Samsonite's 'American Tourister' at a similar price point while in the super-premium segment, it launched 'Carlton' in India in 2010 which was acquired in 2004. In order to promote these brands, VIP had also been signing up celebrities as brand ambassadors - Shahid Kapoor for the eponymous 'VIP' brand, Bipasha Basu for 'Aristocrat' in 2010 and John Abraham for 'Skybags' in 2011.

VIP - Brand Pyramid

Shift in Revenue Mix - Augmenting Share of Soft Luggage Sales: Much to the luggage makers delight, over the years, the trend has swung in favor of soft luggage vis-a-vis hard luggage. Soft luggage commands higher margins and faster replacement demand vs. hard luggage - In FY13, soft luggage contributed to 65% of sales and to a preponderant 85% of profits. Hence, the company lay greater thrust on soft luggage sales which is further evinced by the below exhibit. Nevertheless, the gross margins didn't improve for VIP due to the currency fluctuation - VIP imports its soft luggage from China.

|

Soft Luggage Share -Inching Up |

FY11 | FY12 | FY13 | FY14 |

| Soft Luggage | 56% | 61% | 66% | 70% |

| Hard Luggage | 40% | 35% | 30% | 26% |

| Furniture (Institutional) | 4% | 4% | 4% | 4% |

Strategic Product Basket Diversification -Foray in Ladies Handbags: The largely need based & functional nature of luggage products, low growth of around 12% in the organized luggage market and the difficulty in retailing these products has led the company to diversify into ladies handbags. Branded ladies handbags vis-vis luggage products have relatively higher growth rates and comparable average realizations while occupying to 1/3rd retail space. Thus, VIP launched 'Caprese', a premium handbag brand, in Oct, 2012 which would piggyback on its existing distribution network of exclusive VIP lounges, Multi Brand Outlets (MBOs) & modern trade channels department stores and hypermarkets. VIP's rival, Samsonite's associate company also has a presence in this space through Lavie handbags.

B. Raw Material Cost Control - Switch to In-house Manufacturing

Since FY08, the employee, advertising, rent, discount, freight and other operating costs have remained fairly stable as % of sales. Despite this and the increasing share of more profitable soft luggage products, VIP's EBITDA margins haven't increased; on the contrary they have declined. This is due to the yuan appreciation against rupee. All the soft luggage is purchased as finished goods from China thereby exposing VIP to currency risk. In order to mitigate these risks, VIP has incorporated a subsidiary in Bangladesh to manufacture soft luggage and to reduce dependency on Chinese imports.

Samsonite - A Real Threat to VIP? Since Samsonite embarked on its calibrated growth journey in India in 2002, VIP's market share in the ~Rs. 2,000 crores organized luggage industry, has reduced from a whopping 90% to ~55% over the years. On the contrary, Samsonite's revenue has grown at a spectacular 28% CAGR from CY09 to CY13 on the back of its dominance in the super-premium segment and augmenting supremacy in the mid-to-premium segment.

VIP Ceding Market Share, Samsonite Gaining Traction

| Brand category | Price Range (Rs.) | VIP | Samsonite |

Organized luggage market |

|---|---|---|---|---|

| Mass | <3,000 | 80% | NIL | Rs. 600 crore |

| Mid-to-premium | 3,000 - 8,000 | 45% | 45% | Rs. 1,100 crore |

| Super-premium | >8,000 | <10% | 90% | Rs. 300 crore |

Source: Industry Estimates

Historically, Samsonite has been the undisputed leader in the super-premium category while VIP has been the leader in the mass segment. But, Samsonite started gaining momentum in the mid-to-premium segment after the launch of its blockbuster brand, American Tourister in 2007 -In calendar year 2013, American Tourister accounted for ~75%+ of Samsonite's revenues. Having established its foothold in mid-to-premium and super-premium segments, Samsonite is now preparing to enter the mass segment which offers the 2nd largest market for branded luggage products in India.

Prospero Tree View

In India and across the globe, the organized luggage industry is oligopolistic (few players) in nature due to the difficulty in retailing these products - luggage has not been an 'impulse-buy'product andit occupies 2X to 3X the retail space that of other relatively higher margin accessory products. VIP is trying to address this difficulty by venturing into ladies handbags. But any material contribution from ladies handbags to VIP's growth is far away as popular brands like Da Milano, Baggit and HiDesign which have a presence in India for more than 10 years are clocking annual revenues of less than Rs. 150 crores.

The manufacturing operations have commenced in VIP's Bangladesh subsidiary in Jan, 2014 but will gain meaningful scale only over the next 2 to 4 years. Until then, the margins will be exposed to currency risks.

The competition is set to become only fiercer with Samsonite's planned foray in mass segment, which if turns successful, could severely further erode VIP's market share. On the other hand, macro indicators look promising with burgeoning urbanization and growth in tourism which could augur well for VIP. We believe that in the meantime, the biggest challenge for VIP is to achieve a sustained topline growth and tackle competition.