Dalal Street's poster boy, Rakesh Jhunjhunwala (RJ), was first exposed to stock markets while his father discussed stocks with his friends.While pursuing CA, his interest in stock markets deepened and it led to him visiting the trading ring (computerization came later) often to get a feel of the place. He started investing with a very small amount of funds in 1985; but today, his disclosed stock market portfolio is worth Rs. 8300 crores. The story of rising from a normal middle class family to a billionaire from stock market gains has captured the imagination of a lot of people. Prospero Tree endeavours to cut out the noise around RJ and provide a perspective on his investment philosophy and his portfolio.

Rakesh Jhunjhunwala - The Personality:

He is known to be a very humorous and an audacious person who doesn't mince his words. Through the several appearances on TV interviews and debates, he also comes across as a generally optimistic person.

Initial Big Money:

- First 5 Lakhs: He earned his first big profit of Rs. 5 Lakhs on investment from borrowed funds in 1986 by selling Tata Tea shares at Rs. 143 (in 3 months) which he had bought at Rs. 43.

- Earning Rs. 2 crores by 1989: His net worth rose to Rs. 2 crores by 1989 through significant investment gains in Sesa Goa that rose from Rs. 27 to Rs. 150-175. But after he sold a majority of his shares in that range, the stock price increased to Rs. 2,200 in next couple of years.

- Another 5 times post 1990: It is said that Rakesh Jhunjhunwalas portfolio rose 5 times (400% returns) in 12 months after that years Budget. This would have meant a huge total portfolio size of Rs. 10 - 15 crores in 1990-91.

Rare Combination of Mind, Courage and Patience:

Thomas Phelps has quoted in the book '100 to 1 In the Stock Market', "To make money in stocks you must have the vision to see them, the courage to buy them and the patience to hold them. Patience is the rarest of the three." And RJ has demonstrated that he possesses all the three qualities. After the Initial Big Money made in the stock market, what must have followed is - A series of good stock picking, courage to make big investments and ability to hold positions to make humongous profits. It is this combination of mind, courage and patience that has led him to create wealth through stocks like Titan, Lupin, Crisil among others.

Luck has also played a role:

Though he is a long term investor, he acknowledges that his trading income has tremendously helped him to build his wealth. Needless to say, not everything is pure skill. Not to undermine his talent, there is also an element of luck that he acknowledges. In his words, "I'm the right person at the right place with the right attitude. If the Sensex had not gone up 100 times from when I started, I could not have been successful."

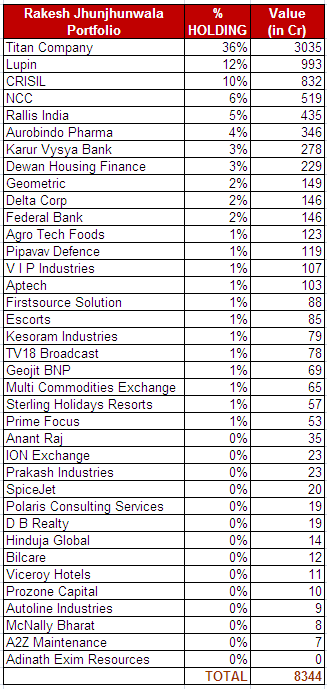

Current Disclosed Rakesh Jhunjhunwala Portfolio:

We at prosperotree.com have put together the recent reported portfolio of the Big Bull which truly reflects his success in investments like Titan, Lupin, Crisil etc.

Below is the list of stocks held as on 29th September 2014 by Rakesh Jhunjhunwala and Rekha Jhunjhunwala:

The above portfolio is the disclosed portfolio based on the exchange filings. However, we believe that RJs total net worth including investments in real estate, unlisted securities and other undisclosed equity holdings should be around double its disclosed stock market holding (just guesswork). This would imply that the number would go anywhere around Rs. 15,000 crores.

Portfolio Observations:

- Allocation: RJ has a concentrated portfolio as top 10 holdings constitute around 80% of his disclosed portfolio. This means that even if all his other stocks go down to zero, it really doesn't materially impact his overall holdings. However, 80% of buzz in the stock markets is related to his bottom 20% of the stocks. For instance, if he buys a couple of crores worth position in Spice Jet, it becomes the talk-of-the-Dalal-Street for most people. This is blasphemous.

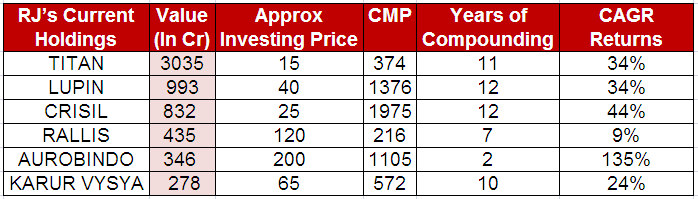

- Big Gains: If you see the biggest gains for RJ came only from a few stocks. Most people will keep talking about hundreds of things that RJ bought and sold and will get excited about everything related to him, but the biggest money made by RJ comes only from a handful of stocks. The below exhibit also reinforces the same point.

Rakesh Jhunjhunwalas Followers: He has a large fan following - people are ready to mindlessly follow him in lure of easy money. However, the biggest buzz amongst his followers is around stocks which constitute a miniscule portion of his overall portfolio. While RJ has certainly created immense wealth for himself, we at Prospero Tree are neither his blind followers nor advocate mimicking his investments, nevertheless, we acknowledge the role of his investment philosophy and portfolio allocation. Some of his investment philosophy has been highlighted below.

Rakesh Jhunjhunwalas Commandments for Investing:

1. Be an optimist! The necessary quality for investing success.

2. Expect a realistic return. Balance fear and greed.

3. Invest on broad parameters and the larger picture. Make it an act of wisdom, not intelligence.

4. Caveat emptor. Never forget this four-letter word - R-I-S-K

5. Be disciplined. Have a game plan

6. Be flexible. For Investing is always in the realms of possibilities.

7. Contrarian investing. Not a rule, not ruled out.

8. Its important what you buy. Its more important at what price you buy.

9. Have conviction. Be patient. Your patience may be tested, but your conviction will be rewarded.

10. Make exit an independent decision, not driven by profit or loss.

In the coming weeks, Prospero Tree will continue to share its insights and thoughts on several other celebrated investors in the stock market community. This will aid you in understanding the various investment philosophies and give you a sense of how the initial big money was made!