Over-information is one of the unintended consequences of living in a technology & media dominated world. The incessant bombardment of information through various newspapers, media channels and financial portals before and after the National Budget can falsely lead you to believe that the National Budget plays a crucial role in your life. The reality however, is quite different. Prospero Tree has highlighted in the past that except for a couple of thousand rupees in lower taxes, National Budget is becoming increasingly irrelevant for the individual tax-payers. Adjusted for inflation, the few thousand rupees that you save courtesy the Budget, amount to nothing.

Robinhood Exercise in the Past

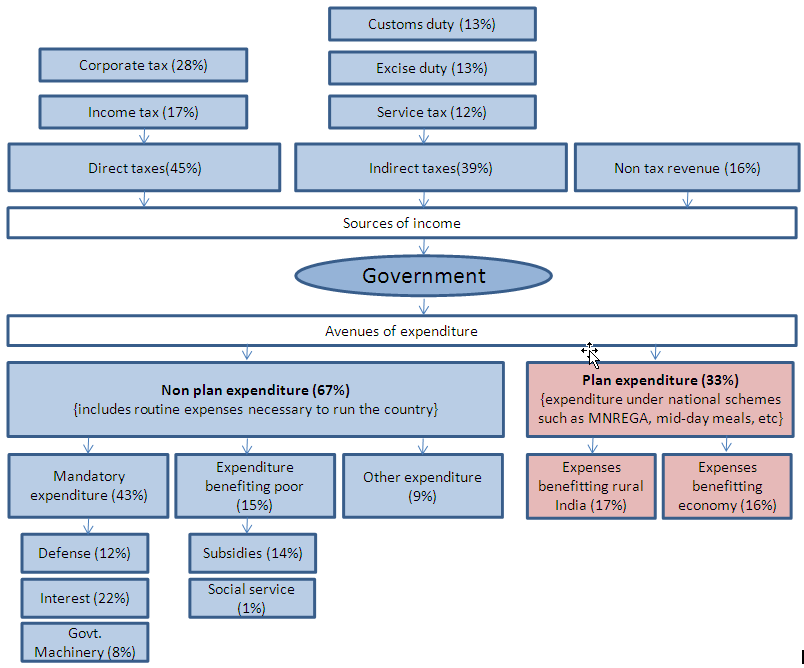

The National Budget is an annual exercise where the Government of India announces how much money it plans to earn (through taxes) and how much money it plans to spend. A detailed look at chart below explains the various sources of income and expenditure for the government and their respective contributions in the past.

Historically, taxes are collected from the minority (~1% of Indian population pays taxes) and distributed for the welfare of the majority (poor population). This trend got pronounced during the UPA regime, which significantly increased the proportion of government revenue used in welfare of the rural population through subsidies. The subsidy bill increased at a staggering 19% CAGR over the past ten years of UPA regime while government revenue grew at ~14% CAGR. Infrastructure and industrial sectors got less than the requisite share of money and that eventually resulted in a broad-based slowdown in the economy.

Spending the tax-payers’ money for benefit of the poor population is a noble thing but the manner in which the money is distributed in India leaves a lot more to be desired. Approximately 40% of the money spent on subsidies is siphoned off and fails to reach the intended individual. There is also an electoral angle to this spending pattern too – spending more money on voters will yield quicker results than spending on infrastructure.

Can the New Government Do Anything Different and Meaningful?

Realizing the folly committed by the previous government, the current government has hit the brakes on subsidy spending and already announced its intention of plugging the pilferage in subsidy distribution through usage of Aadhar linked accounts. Given the protracted nature of the economic slowdown, the new government is expected to allocate more money for infrastructure sector (affordable housing and roads) and announce sops to manufacturing sector to kick-start the economy. This Government has clearly highlighted that its policy initiatives will be directed towards job creation. The Budget this time could be a little different compared to the UPA regime.

Prospero Tree View – How Can You Benefit From The Budget?

Budget is the Government’s platform to communicate its areas of priority. During the past 10 years, rural and semi-urban India was clearly the focus area for the government and they received a large part of Budget funds. This resulted in higher rural incomes and translated to strong sales for companies like Hero Honda, TTK Prestige, HUL, etc. Stocks of these companies gave multi-bagger returns.

The priority of this government for the next few years would be to revive the industrial economy and kick-start the investment cycle. Specific allocations and policy support could be provided to defense, irrigation, affordable housing, roads and capital goods sectors. This will open up some long term investing opportunities in the above sectors and we at Prospero Tree would point that out as and when they arise.

Once again, we would like to re-iterate that Budget is an irrelevant exercise for the middle class when viewed in isolation. However, one can benefit from the Budget by investing in stocks that are likely to gain from government spending. Also remember that long term capital gains tax on income from stocks and equity mutual funds is ZERO. This implies that irrespective of your tax slab, all your income from stocks held for more than a year is tax free. No other asset class gives you this benefit.

You may also read our previous article on Budget:

Budget 2014 - Baby Steps Towards the Grand Indian Vision