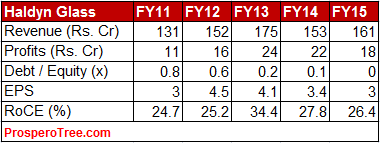

| Name | Haldyn Glass |

| Type of Report | First Recommendation |

| Report Date | Feb 5, 2016 |

| Price on Report Date | Rs. 36 |

| Current Market Cap | Rs. 193 Cr |

| View | Buy |

| Indicative Target Price* | Rs. 50 |

Company Background: Haldyn Glass is 5th largest manufacturer of clear glass and flint glass bottles in India having a total melting capacity of 390 tons per day. Haldyn supplies glass bottles mainly to food and beverage, pharmaceutical and liquor industry. Some of its clients include United Spirits, Amul, Tilaknagar Industries, Zydus, Empee, Bajaj consumer among others.

Investment arguments:

1) Higher revenue and profits from fully operational expanded capacity: Until Oct2015, Haldyn had a capacity of 320 tons per day and was operating at near 90% utilization levels. Considering high industry un-utilized capacity, Haldyn did not undergo any capacity expansion. As an outcome, Haldyn sales stagnated in the range of Rs. 150 - 160 cr between FY10 to FY15. With industry over-capacity now reducing due to increased demand over the years, Haldyn undertook a 30 crores expansion in FY16 to increase its capacity from 320 to 390 tons per day. As a part of this expansion, one of the existing glass furnaces had to stop production affecting the Q2FY16 results.

Since Oct2015, the expanded capacity is fully operational with both the glass furnaces running. Haldyn plans to use the additional capacity to manufacture container jars for pickles and jams. This can help Haldyn to increase its sales after stagnating growth for last 4 years and thereby help boost its profitability.

2) Operating margin to improve: Haldyn’s cost structure mainly include cost of raw material(silica & chemicals), power and packaging materials. Considering the global commodity down fall, the raw material costs, power costs and packaging costs should see reasonable savings in coming results. For instance, raw material cost for Haldyn decreased from 33% of sales in FY14 to 29% of sales in FY15 and the same trend can continue further.

Haldyn’s furnaces currently use Natural gas for its power and heating requirements. Nearly 50%-60% of the current gas is available to Haldyn at the administered price set by government of India. The administered price is notified once every six months by GOI and has fallen from $5.05 in Nov14 - Mar15 to $3.82 USD in Oct15 - Mar16 period. Even after adjusting the decrease of gas allocation at administered price mechanism (lower price), the embedded cost of natural gas for Haldyn is on the decline and should translate into better earnings.

3) Joint Venture with international leader, HeinzGlas: After five long years of negotiations, Haldyn entered into JV with Germany based HeinzGlas (named: HaldynHeinzGlas) to manufacture perfume & cosmetic bottles. The JV will involve an investment of Rs. 60 crores and manufacturing capacity of 40 tons per day. The equity contribution by Haldyn and Heinz will be to the tune of Rs. 20 crore each while the remaining will be funded through debt. The technology to manufacture high-end perfume and cosmetic bottles will be provided by Heinz and large part of the production will be sold globally through Heinz. The plant is expected to commence production by July’16 and will have a revenue potential of Rs. 100 crore to Rs. 150 crore. It is important to note that the products that will be manufactured through this JV will have higher margin.

4) Balance Sheet problems of peers to restrict them from expanding further: In 2010-2012,most industry players have expanded their capacities taking large debt on balance sheet and the effects of the same are seen in the form of high debt to equity ratio. The current balance sheet weakness of these large players will ensure that no more capacities are being added in the industry making it favorable for players like Haldyn.

5) Haldyn -Excellent Capital Allocator: While the major industry players were heavily expanding capacities through leverage, Haldyn refrained from increasing the capacity. Instead it paid healthy dividends from its profits and focused on financial prudence. Looking at the past 5 years, we find Haldyn capital allocation strategy very healthy as below:

- Not expanding while other players were expanding capacities

- Instead paid continuously good dividends out of profits

- And retiring debt in last 4 years to achieve debt free status

- In FY16, Haldyn invested Rs. 30 crores to increase capacity from 320 tpd to 390 tpd

- In FY16, Haldyn formed a JV with HeinzGlas to setup high margin glass manufacturing plant for perfume and cosmetic industry with equity investments of Rs. 20 crores.

All of above has been done while maintaining debt free balance sheet

6) Restriction on usage of Plastics to help glass bottle industry: Very recently, the Maharashtra Government banned sales of liquor in plastic bottles due to the health hazard (cancer) caused by it. This creates opportunity for companies like Haldyn who are supplying to Liquor manufacturers. With Maharashtra government now taking the lead, there will be many other state governments who may follow the foot steps in the similar direction.

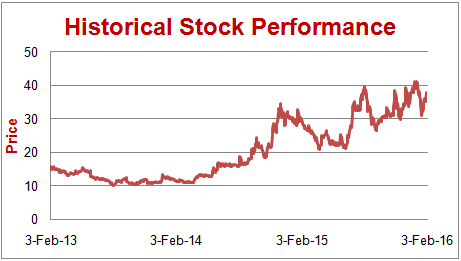

Valuation: At the current market price of Rs. 36, Haldyn is trading at a market cap of Rs. 193 crores having average profits of Rs. 21 cores. Over last 3 years, Haldyn has generated cash worth nearly 75 crores against its market cap of Rs. 193 crores suggesting good value. Based on historical earnings, the company is available at a price to earnings multiple of 12 times. Considering the potential sales growth coming from expanded capacity and high margin revenues from the JV, Haldyn looks to provide reasonable upside from current levels. We therefore suggest a BUY in Haldyn at Rs. 34-35.

Key risks:

1) Reduction of allocation of Gas at the administered price mechanism: Currently 50%-60% of gas procurement by Haldyn is done at subsidized gas price known as administered gas price. If government further decreases the allocation of gas at administered price, the cost of gas will increase for the company. However, as the market rate of gas is decreasing with the global commodity price fall, this should not affect Haldyn in a big way. The above risk is not applicable to the HeinzGlas JV as it will be completely reliant on furnace oil at open market rates.

2) Threat of substitutes: Further PET bottles and aluminum cans substitution instead of glass can be a threat. However, glass has some advantages that wouldn't allow substitution in sectors like alcohol, pharma, perfumes and cosmetics. In fact, recently there has been a reversal of trend from usage of plastics to usage of glass bottles esp in medicines and liquor due to the environmental and health hazard caused by usage of plastics bottles.

Historical Stock Price:

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

- Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

- Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

- Buy: This means buying the concerned stock at current market price.

- Buy on Dips: This means buying the concerned stock on the explained fall in price.

- Hold: This means holding the concerned stock until further update.

- Sell Partial: This means selling half of the existing position in the concerned stock.

- Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.