|

Name |

AstraZeneca Pharma India |

|

Type of Report |

First Recommendation |

|

Report Date |

Feb 10, 2016 |

|

Price on Report Date |

Rs. 1194 |

|

Current Market Cap |

Rs. 2985 Cr |

|

View |

Buy |

|

Indicative Target Price* |

Rs. 1700-1800 |

Company Background: AstraZeneca Pharma India (AstraZeneca India) was established in 1979 and is headquartered at Bengaluru, Karnataka. AstraZeneca India's more than 90% revenues come from manufacturing and marketing its parent product in India. AstraZeneca India is a debt free company with 75% ownership held by AstraZeneca Plc (through AstraZeneca Pharma Sweden).

Investment arguments

1) Strong Existing Product Basket: AstraZeneca India has strong brands portfolio with more than 50 products in India across 7 segments in India -Cardiovascular, Diabetes, Oncology, Respiratory & Inflammation, Infection, Local Anesthesia and Maternal Healthcare. Some of its major brands that are leaders in their category includes Meronem (Infection), Seloken XL (Cardio), Crestor (Cardio), Arimidex (Oncology), Zoladex (Oncology), Neksium (Gastro) and most recently Brilinta (Cardio) and Forxiga (Diabetes).

2) New Products Introduction from Global Portfolio gives Visibility: Over the last 10 years, AstraZeneca has been regularly launching products from its global portfolio in India. In recent years, the launch and marketing focus has accelerated as seen from:

-

Launch of Brilinta, a cholesterol control drug that became #1 brand within 29 months. The company is further expanding the reach of this product.

-

Launch of Forxiga, an innovative novel drug launched has triple benefit of HbA1c Control, Weight Loss and Blood Pressure reduction.

-

Expanding the market for other recently launched products Onglyza (sexagliptin / diabetes), Kombiglyze (sexagliptin combination / diabetes) and Symbicort

-

Marketing tie-up for new brand Riax with Dr Reddy. Riax will be similar to Kombiglyze that is marketed by AstraZeneca alone.

-

Marketing tie-up for new brand Axcer with Sun Pharma. Axcer will be similar to Brilianta that is marketed by AstraZeneca alone.

AstraZeneca's accelerating activity in India, its global product basket and research pipeline provides excellent long term visibility in India.

3) Recent Results Suggests Strong Traction: AstraZeneca's India business is one of the smallest among prominent foreign firms, but the company has one of the highest growth rates. In 9mFY16, the company revenues increased by 16% YoY with the 3QFY16 quarter clocking a growth of 33% YoY. Going by the current run-rate, the company should achieve enough sales where it could see significant improvement in profits.

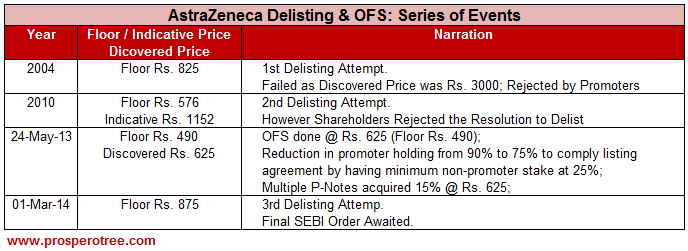

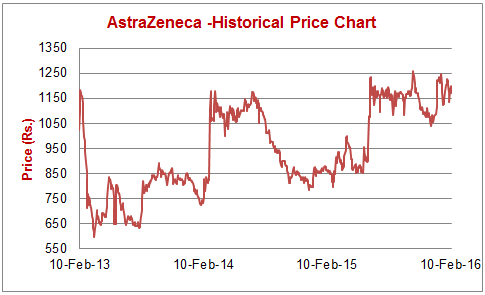

4) Delisting subject to SEBI Approval: AstraZeneca Pharma AB, the promoter of AstraZeneca Pharma India Ltd. who currently holds 75% in the company made a third attempt for voluntary delisting with the floor price of Rs. 875. However, two minority shareholders filed a petition against the delisting and SAT directed SEBI to complete investigation by 11Mar2016 and pass an appropriate order on Merit. If the awaited SEBI order gives a go-ahead to the promoters for delisting, the floor price will cushion the downside and the promoter’s eagerness to delisting as seen from its third attempt may provide immediate sizable gains.

To better understand the entire delisting episode of AstraZeneca, please refer the table below:

Below two technical factors point at a potential better discovery price if SEBI approves the delisting:

a) Very recently, ICICI prudential mutual fund has acquired nearly 7% stake through multiple block in AstraZeneca Pharma India Ltd at a price of Rs. 1150-1175. Being a sole largest non-promoter shareholder, the tender price of ICICI Prudential (if delisting goes through) will be crucial for the success of delisting.

The acquisition by ICICI prudential at Rs. 1150-1175 may help in better price discovery if the delisting goes through.

b) Recently Fulford, another MNC Pharma company, got delisted at Rs 2400 per share against its floor price of Rs.701. Though it is not necessary for AstraZeneca promoter to pay such high premium but looking at Indian business growth rate, strong pipeline of products introductions and eagerness to delist as seen from its 3rd attempt, the possibility of delisting at significant premium to floor price cannot be ruled out.

Considering the business improvement and a cushion added by delisting possibility, AstraZeneca provides good upside opportunity with protected downside and fits the classic case of --- "Heads, I win; Tails, I don’t lose much"

Key risks:

-

1. SEBI not allowing the delisting to go through.

-

2. Even if SEBI allows Delisting to go through, the delisting can fail due to non-acceptance of discover price or less than required number of shares being tendered in the delisting process.

-

3. Offer for Sale raises Corporate Governance Flag: The Company did an OFS in May2013 where all the buyers who participated were mainly through P-notes. It raises a suspicion that the buyer may have been connected to the promoters.

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

1. Explanation of Type of Report

-

Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

-

Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

2. Explanation of Time Horizon: All the Fresh Recommendation reports in the investing section have a view of 3-5 years.

3. Explanation of Views: Views can be any one among these - Buy, Buy on Dips, Hold, Sell Partial, Exit

-

Buy: This means buying the concerned stock at current market price.

-

Buy on Dips: This means buying the concerned stock on the explained fall in price.

-

Hold: This means holding the concerned stock until further update.

-

Sell Partial: This means selling half of the existing position in the concerned stock.

-

Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.