| Name | Alphageo India Ltd |

| Type of Report | First Recommendation |

| Report Date | Jan 5, 2017 |

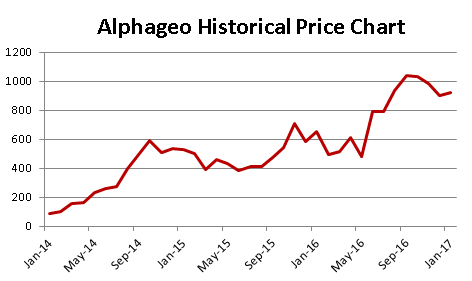

| Price on Report Date | Rs. 937 |

| Current Market Cap | Rs. 554 crores |

| View | Buy |

| Indicative Target Price* | Rs. 1400 |

Company Background: Alphageo (India) Ltd engaged in providing onshore (within land) seismic survey in India as well as in international terrains. Seismic survey is an important activity to be carried out for exploration companies as it provides vital information about the location and potential size of the reserve below ground. On the basis of this information, exploration companies decide the economic viability of the exploration.

Typically Seismic surveys are carried out in three steps for identifying the reserves of hydrocarbon (such as oil & gas), coal, ores & minerals -Data acquisition, Data processing, and Data interpretation.

Investment Arguments:

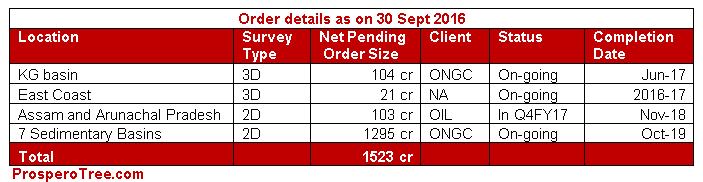

1. Current Order Book Higher Than Last 10 Year Sales: As on Sep16, Alphageo has an order book worth Rs.1523 crores net of taxes against total executed orders worth Rs. 670 crores between FY05 to FY16. As per the terms of the contract, current orders will be executed within 3 years before Dec2019. The execution of order book provides clear visibility of earning for the next few years and will make company financially much stronger to bid for future orders aggressively.

2. Government thrust on Exploration to Unlock Long Term Opportunities: Indian government has set an aim to achieve self-sufficiency in oil and gas sector through exploring hydrocarbon reserves in India. India has a total sedimentary area of 31.4 lakh sq. km across 26 sedimentary basins out of which only 15 basins has been assessed so far. Among 31.4 lakhs sq. km, 13.5 lakhs sq. km are in deep water (Offshore) while 17.9 lakhs sq. km are on-land (onshore) areas. All the onshore areas shall be covered by 2D seismic survey within a time span of 5 years through ONGC and OIL. This clearly gives an indication to the large opportunity size for future activity in seismic survey market.

-

Opportunities through National Seismic Program: In this direction, the government recently announced tenders under the National Seismic Program (NSP) that aims to find the hydro-carbon reserves. The Directorate General of Hydrocarbon (DGH) through ONGC & OIL had floated order for 2D seismic data acquisition in un-appraised on-land areas of 48243 LKM (per line Kilometers). Out of this, Alphageo was awarded orders for 26905 LKM to conduct seismic survey by ONGC. This 48243 LKM order by NSP is just a beginning under this program when we see the potential of orders that may flow from un-appraised size of areas.

-

Opportunities Post OALP Bidding: Once data is acquired under National Seismic Program as above, E&P companies would select blocks for exploration under Open acreage licensing policy (OALP). As a first step, these E&P players would take a more intensive 2D seismic survey with data acquisition lines will be closer. This could also be followed by 3D seismic survey on the same land. This can bring additional opportunities for companies like Alphageo.

-

Opportunities from Marginal Oil & Gas Fields & CBM Fields: The marginal oil & gas fields which were written off in past are also being re-explored bringing in the potential for 3D surveys. In the similar manner, the Coal bed Methane (CBM) fields are also expected to carve out new opportunities for companies in this sector and Alphageo is expected to have a fair share of the same.

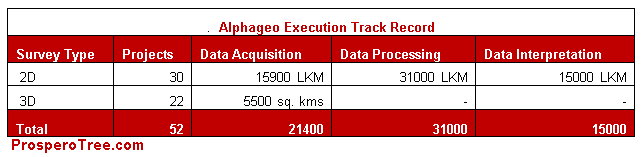

3. Strong Track Record Suggest Superior Execution Skills: In the past, Alphageo has conducted 2D & 3D seismic survey in an innovative, cost effective and efficient manner for reputed clients like ONGC, OIL, GAIL, Hardy exploration & production Inc., and GSPL among others. Their timely & efficient execution track record has helped the company in receiving repeated order from these clients. Alphageo is also known globally through its subsidiary –Alphageo International Ltd and step down subsidiary –Alphageo DMCC at Dubai which is setup to carry out survey activities internationally.

Within India, the company has a vast experience and multi-terrain capability across North-east, Western and Southern India. Company presently has 10 multinational crews over 1000 men and has a channel count in excess of 15900 units. The company has successfully completed 52 projects for 33 customers in 3 countries.

4. Strong Balance Sheet, Technology Up gradation along with Fund Infusion by Promoter: As on Sep2016, the company has a total net-worth of Rs. 120 crores with gross debt of Rs. 25 crores. In addition to Rs. 49 crores spent on technology upgradation over last three years, company has spent another Rs. 80 crores in H1FY17 to upgrade & acquire essential equipment’s against which there are pending dues of Rs. 55 crores. To support the recent capex, the promoters decided to infuse funds by allotting 7.3 lakh convertible warrants in November 2015 at Rs. 513.62. This means by May2017, the promoters will in all infuse Rs. 37.4 crores in the company. The promoters have already taken conversion of 2.75 lakh warrants and thereby infuse the fund of Rs. 14 crores in the company. This will ease the need of funds as the company is going to execute its lifetime largest order.

Valuation: At Rs. 937, Alphageo is trading at a market cap of Rs. 554 crores with an average profit of Rs. 18 crores for past 3 years. In FY16, it executed orders worth Rs. 90 crores, making a profit of Rs. 12 crores, a cash profit of Rs. 24 crores and stands with a net worth of Rs. 106 crores. Today Alphageo has an order book of Rs. 1523 crores that will be executed continuously till Dec19. Considering its current order book, large opportunity ahead led by government ambition of reducing import dependency and experienced management team along with strong track record, the company provide reasonable upside from current levels with strong downside support. We therefore suggest buying Alphageo at current market price.

Key risks:

1. Delay in order execution can lead to cost overruns and affect profitability

2. Financial performance could be volatile as revenues depends on order execution & seasonality factor

Historical Price Chart

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

- Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

- Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

- Buy: This means buying the concerned stock at current market price.

- Buy on Dips: This means buying the concerned stock on the explained fall in price.

- Hold: This means holding the concerned stock until further update.

- Sell Partial: This means selling half of the existing position in the concerned stock.

- Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.