| Name | GIC Housing |

| Type of Report | First Recommendation |

| Report Date | Jan 30, 2017 |

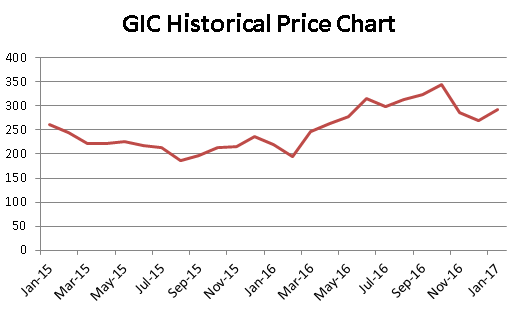

| Price on Report Date | Rs. 291 |

| Current Market Cap | Rs. 1565 crores |

| View | Buy |

| Indicative Target Price* | Rs. 385 |

Company Background: GIC Housing Finance Limited (GIC) is a housing finance company formed in 1993 and is promoted by General Insurance Corporation of India and its erstwhile subsidiaries namely, National Insurance Company Limited, The New India Assurance Company Limited, The Oriental Insurance Company Limited and United India Insurance Company Limited.

GIC provides loans only to individuals for purchase or construction of residential houses. GIC Does not provide any loans to real estate developers.

Investment Arguments:

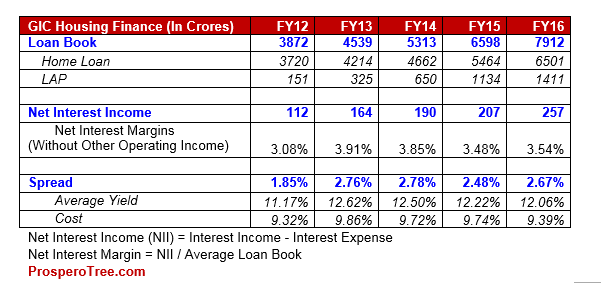

1. Growing Loan book with Stable NIM: GIC loan book has shown a growth of approximately 20% CAGR over last 4 years from Rs. 3872 crores in FY12 to Rs. 7912 crores in FY16. The doubling of loan book in last 4 years has been achieved along with broadly maintaining its net interest margins (NIMs). In the first half of the year, GIC loan book has further grown by 9% and reached to Rs. 8623 crores. Considering the overall strong demand of housing loans along with expansion efforts by GIC seen in recent past (explained below), the growth momentum is likely to continue going ahead.

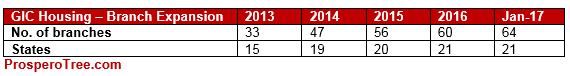

2. Increasing Reach through Branch Expansion: GIC has almost doubled the branch strength from 33 in FY13 to 64 branches by Jan2017 and is now present across 21 states in India. All these branches are opened in TIER II cities or areas with high demand for housing loan. At the same time the competition for GIC is comparatively lower due to its focus on small borrower where average loan size is small. The territorial expansion through increase in branch should help the company sustain growth and reduce geographical risk.

3. Small Ticket Lending Helps in Reducing Risk: GIC Housing Finance provides loans only to individuals for purchase or construction of residential houses. The company has 68% of its loans given to salaried class whereas remaining 32% are given to self-employed category which includes professionals and businessmen. The average loan size for GIC is fairly small at Rs. 14 lakhs per loan.

All of this makes GIC Housing Finance loan book quite robust and reduces the risk of default to the company.

4. Loan against Property (LAP) to Improve Net Interest Margin (NIM): In order to improve NIMs, the company provides loans to individuals against their properties (LAP). Usually, the rate of interest for LAP is higher than that of housing loan which helps the company to earn higher margins. As on 31Dec2016, GIC’s LAP portfolio is nearly at 15% of total outstanding loans standing at Rs. 1362 crores. The company will continue to cautiously growth in this segment and thereby sustain on the margin fronts.

However, LAP being slightly more riskier as a product, the company tries to have tight control on NPAs, by relying on third party independent valuers and caps the maximum loan to value (LTV) for Loan Against Property at 60% for property value.

5. Trends Supporting Housing Finance Companies:

- Strong Government initiatives for housing sector: The Government commitment of Housing For All by 2022 under various government sponsored schemes like Pradhan Mantri Awas Yojana (Urban and rural), subvention of interest for housing loans and Income tax benefit to borrower on principal and interest payment is expected to generate a very strong demand for houses across India. This would augur well for the housing finance companies across India.

- Softening of Interest rate to help spur Long Term Demand: Post demonetization due to large liquidity surplus, the interest rate in general have fallen to multi years low. Along with lower interest rate and softening/stable real estate prices, purchasing a home has become much more attractive than in the recent past. The narrowing of the gap between home loan rate and rental yield will make it further logical to buy own housing property. This should help housing finance companies like GIC over a longer term.

- Curbing of Black Money to help off take of housing loans: Demonetisation has changed the operating environment such that the black money component is expected to reduce drastically. This forces a lot of home buyers in the self-employed professionals and business class to opt for housing loans as builders stop accepting large amount of black money. GIC’s expertise in dealing with self-employed professionals and business class would help the company to capture growth from this trend as well.

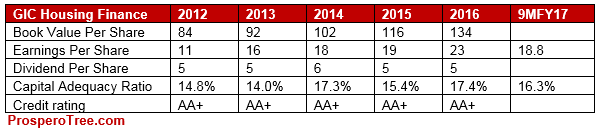

Valuations: At current price of Rs. 292, GIC has a market cap of Rs. 1565 crores, FY16 PAT of Rs. 125 crores and FY16 EPS of Rs. 23 indicating a trailing price to earnings ratio of 13 times. On the price to book basis, GIC is trading at a price to book at 2.2 times FY16. GIC has also been paying substantial dividend for many years with FY16 dividends at Rs. 5 per share.

Considering the over sector positives, GICs growth profile, its strong promoter, efforts towards improving GNPAs profile, strong existing return profile and good dividend yield, GIC is fairly undervalued to its peer companies. We therefore recommend to BUY with current market price.

Key Risk:

- Rising Competition: The competition from the various housing finance companies and the banks may reduce the NIM. However, the growth in overall housing finance may compensate the fall in NIM.

- 2. Higher GNPA: In FY16, Gross Net Performing Asset (GNPA) of GIC stands at 1.76% or Rs. 139 crores. However, as a conservative policy company has made a provision of Rs. 204 crores which includes excess provision of Rs. 84 crores than what is prescribed for the GNPA as on 31Mar2016. Post Demonetisation, GIC's GNPA have increased further; however the same is expected to be rationalized once the economy comes to normalcy in the next 6 months.

Historical Share Price:

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

- Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

- Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

- Buy: This means buying the concerned stock at current market price.

- Buy on Dips: This means buying the concerned stock on the explained fall in price.

- Hold: This means holding the concerned stock until further update.

- Sell Partial: This means selling half of the existing position in the concerned stock.

- Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.