|

Name |

BSE (Bombay Stock Exchange) |

|

Type of Report |

First Recommendation |

|

Report Date |

Mar 29, 2017 |

|

Price on Report Date |

Rs. 945 |

|

Current Market Cap |

Rs. 5076 crores |

|

View |

Buy |

|

Indicative Target Price* |

Rs. 1400 |

Introduction: Stock exchange is a platform where participants can buy or sell listed securities likes Equity, Debt, Mutual Fund units, Currencies or Derivatives of these underlying. The securities can be traded through registered brokers of the exchange. After companies raises funds through primary issue, exchange help in providing a trading facility for the securities on the secondary market.

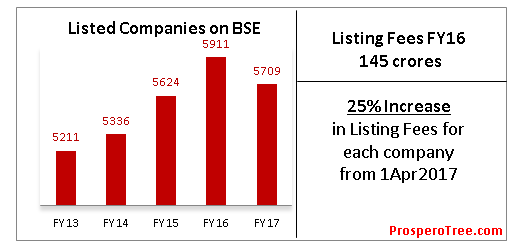

Established in 1875, Bombay Stock Exchange (BSE) is India's premier leading stock exchange and is also a first listed stock exchange in India. As on Mar2017, 5709 companies are listed on BSE, making it world's largest exchange in terms of listed companies. These listed companies together have a market cap of Rs. 119.80 lakh crores (Rs 119.80 trillion).

BSE earns its revenues from two major categories of its users:

a) Revenue From Corporates:

-

Upfront listing fees to allow trading on stock exchange according to capital base

-

Fees for book building software for IPO, Buyback, Delisting, OFS, etc.

b) Revenues From Brokers / Market Participants:

-

BSE has 1446 unique member across equity cash / derivative and currency derivative segment. Members are required to pay interest free deposit on which BSE generates investment income.

-

Members are also required to pay annual subscription to stock exchange.

-

The Buyers / Sellers are charged a transaction charge one each purchase and sale depending upon its value or number of trades.

Investment Arguments:

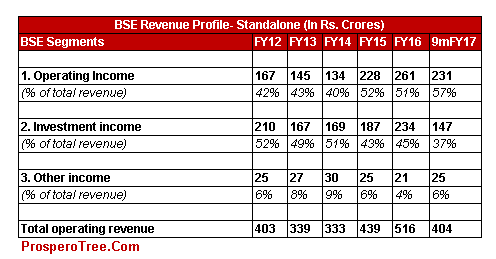

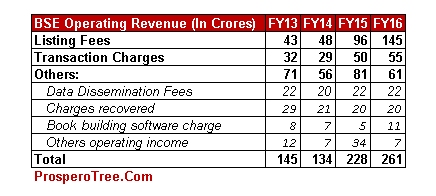

1.Operating Income to growth at a healthy pace: BSE earns its operating income under 3 major heads –Listing Fees, Transaction Charges and Others. With a very supportive economic environment, new listings and changes in the transaction charges structure, the operating incomes can increase significantly from the currently levels. In 9mFY17, its operating income grew by 30% yoy from Rs. 177 crores to Rs.231 crores. BSE not only succeeded in increasing its operating revenue but also succeeded in changing the revenue mix with operating income overtaking the investment income. Today, operating income consist of 57% of total revenue as against 40% of total revenues in FY14.

-

Listing Fees: BSE charges listing fees to each company that is listed on BSE. The listing fees are fixed in nature and are charged by BSE on a yearly basis based on the paid up capital of each company. Due to increase in number of companies and changes in the capital structure of each company, BSE listing fees witnessed a growth of 50% CAGR from FY13 to FY16. BSE has announced an increase of approximate 25% in listing fees for all companies applicable from 1Apr2017. In addition to the hike in listing fees, there is a large IPO pipeline waiting to get listed in FY18. The effect of both of these should be visible in FY18 numbers.

-

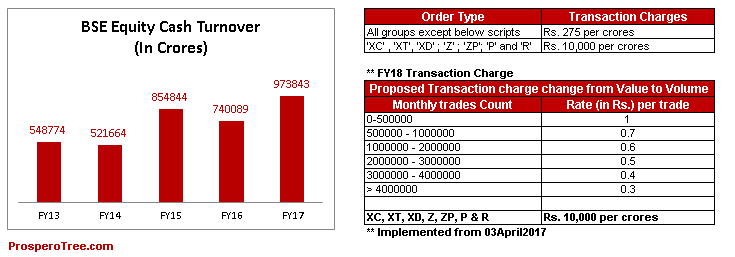

Transaction Charges: BSE generates income from trades executed on exchange platform in various segments like equity, currency and BSE Star MF. All these segments are expected to see sustained growth in volume and / or value over the next few years.

-

Equity Cash Segment: As of FY17, BSE transaction charges for equity segment are linked to the value turnover and the segment of the equity (shown in table below). Over the last 5 years, BSE has seen an increasing trend in the turnover and achieved highest turnover in FY17. It has also been able to increase its market share in FY17. The transaction charges income from equity segment is expected to further increase with the proposed changes from value turnover model to trade volume model. On an average, BSE equity cash segment is quite active with average daily trades of approximately 16-17 lakhs trades per day. In future, BSE should be able to achieve growth in transaction charges with help of increased volume and better pricing.

-

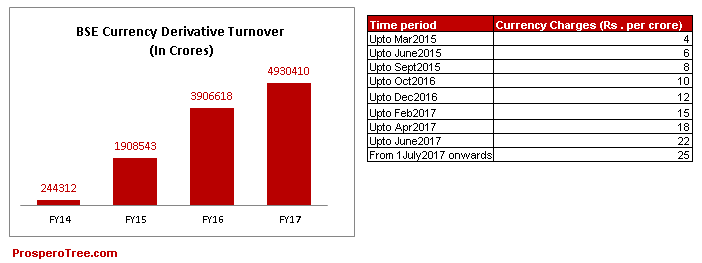

BSE Currency Derivative Segment (CDS) ahead of other exchanges: In spite of the late entry in currency derivatives segment in FY14, BSE CDS has emerged as a market leader with an average daily turnover of more than Rs. 20000 crores. The revenue from CDS segment is improving every year led by consistent turnover growth and gradual hike in transaction charge for CDS.

-

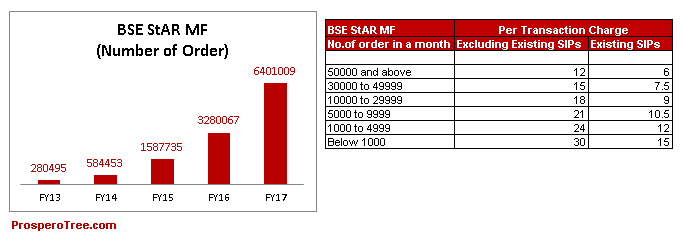

BSE StAR Mutual Fund: BSE StAR MF platform is a one of the best platform for mutual fund transactions for investors and mutual funds distributors. The comprehensive platform provides a range of services, which facilitates ease of transactions and results in seamless order flow for MF AMCs. Initially, BSE started this segment without any charges and has started collecting transaction charges from AMCs from 1Dec2016 on transaction basis. The transactions in BSE StAR MF is growing @100% since last 5 years and is expected to grow at a healthy rate.

-

-

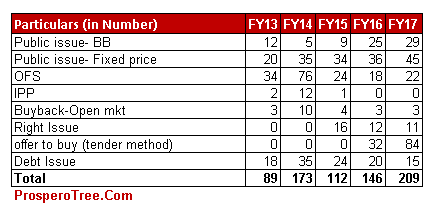

Increasing Book Building Software Charges and Website Usage Charges: BSE provides its book building software facility to companies for various other purpose such as public issue, offer for sale (OFS), offer to buy (OTB), debt issuance among others. As shown below, companies using BSE software for various purposes have increase from 89 in FY13 to 209 in FY17 and is expected to grow with the overall growth of market.

Every year, BSE receives Rs. 25-30 crores from website usage and rent charges and this has been a very stable income for the company.

2. Stable Investment Income: Investment income is the second highest income followed by operating income. BSE earns interest and dividend from its surplus cash invested in tax free bonds, bank deposits and long term investments in subsidiaries. In 9mFY17, BSE earned, Rs. 147 crores from investment income. Though termed as investment income, this is recurring in nature and provides good stability in earnings. It is noteworthy that any exchange, as is the case of BSE, operates on negative working capital as it is able to collect the fees and charges on an upfront basis from its users.

3. Jewels of subsidiaries: BSE has some jewels in the form of subsidiaries which includes Indian Clearing Corporation (100%), INX (100%) and CDSL (50.02%). BSE may have to divest the part of stake (26.02%) in CDSL through IPO to comply with SEBI guidelines which will unlock the value of its investment in CDSL. Indian clearing corporation (ICCL) which performs clearing and settlement work for the trades executed on BSE earns net profit of Rs. 45-48 crores per year which translate in to contribution of EPS Rs. 8-9 at consolidated level. In addition to the subsidiaries, BSE owns the iconic PJ Tower building in the prime most area of Mumbai.

4. No more provisions & exceptional losses: BSE has spent Rs. 269 crores in last 5 years under liquidity enhancement scheme in order to provide liquidity in F&O segment. However, BSE F&O segment failed to generate required liquidity and participation. From FY16, BSE has stopped spending any amount on liquidity enhancement scheme which has started saving Rs. 50-60 crores per year for the company. Moreover, BSE was required to contribute 25% of its profits after tax towards settlement guarantees fund (SGF) every year. In FY16, BSE has contributed Rs. 51.43 crores towards SGF. However, SEBI has removed this provisioning mechanism from 29Aug16.

5. New Initiatives:

-

Growing SME Segment: BSE SME segment enables small and medium enterprises (SME) to raise fund and be listed on the platform. Currently, 165 Companies are listed and BSE is aiming to increase it upto 200 by June 2017.

-

BSE's E-Book Platform: BSE e-book mechanism was launched on 1Jul16 to facilitate Indian companies to raise fund via debt securities through private placement basis. It is mandatory for company to issue debt through exchange’s e-book platform if issue size is more than Rs. 500 crores. In less than year, multiple Indian companies have raised about Rs. 2 lakhs crores through BSE’s e-book platform.

-

India International Exchange (INX): BSE has opened first international exchange at GIFT city on 16Jan17 as a wholly owned subsidiary. India INX operates for 22 hours a day to allow international investors and Non Residents Indians to trade from anywhere across the globe. In the first phase it proposes to commence trading in equity derivatives, currency derivatives, commodity derivatives including Index and Stocks. Subsequently, depository receipts and bonds would be offered once the required infrastructure for the same is in place.

6. Lower Effective Tax Rate: BSE net income is taxed at lower rate due to its income composition. Large part of its investment income (37% of total) comes from tax-free interest income and dividend income. The lower effective tax rate should therefore continue for the company.

Valuation: At Current market price of Rs. 938, BSE Ltd has a market cap of Rs 5026 crores along with cash equivalents worth Rs. 2000 crores. Annualising its 9mFY17 Standalone EPS of Rs. 27 and Consolidated EPS Rs. 32, BSE should post EPS of Rs. 40 at consolidated level for FY17 making it available at less than 24 times price to earnings ratio. The company has a book value of Rs. 418 per share.

Considering potential increase in operating income and a very long term visibility of income, we think that BSE is available at an attractive price and therefore suggest a BUY for the same.

Potential Risk Factor:

-

Volatility in volume: Income from transaction charges is dependent on volume and market sentiment which is beyond company’s control.

-

Regulatory Risk: Business operations are strictly under SEBI guideline. Any adverse change in policy can reduce profitability.

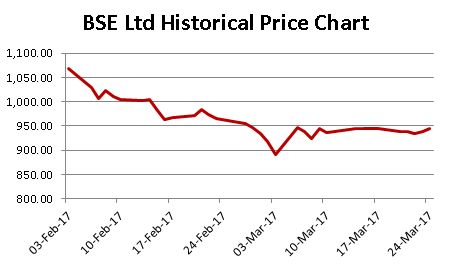

Historical Share Price:

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

1. Explanation of Type of Report

-

Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

-

Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

2. Explanation of Time Horizon: All the Fresh Recommendation reports in the investing section have a view of 3-5 years.

3. Explanation of Views: Views can be any one among these - Buy, Buy on Dips, Hold, Sell Partial, Exit

-

Buy: This means buying the concerned stock at current market price.

-

Buy on Dips: This means buying the concerned stock on the explained fall in price.

-

Hold: This means holding the concerned stock until further update.

-

Sell Partial: This means selling half of the existing position in the concerned stock.

-

Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.