| Name | NMDC Ltd |

| Type of Report | First Recommendation |

| Report Date | July 13, 2017 |

| Price on Report Date | Rs. 119 |

| Current Market Cap | Rs. 37650 crores |

| View | Buy |

| Indicative Target Price* | Rs. 175 |

Introduction: NMDC Ltd is the largest iron ore mining company in India and has produced 34 million tonnes of iron ore for FY17. This production is achieved with the help of its 4 fully mechanised mines -2 mines in Chhattisgarh and 2 mines in Karnataka. NMDC is government promoted company recognized as a Navratna PSU where 75% of stake in company is held by government.

Investment Arguments:

1. Volume Growth To Drive Profitability: NMDC is largest iron ore mining company in India having a very consistent track record in mining operations. However, NMDC has little influence in determining Iron Ore price as it is affected by the global demand and supply dynamics.

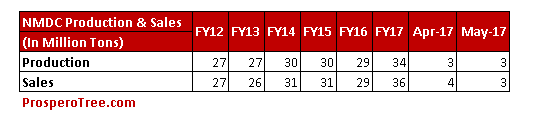

Considering the Indian demand of Iron Ore and in order to maintain its focus on profitability despite price volatility, NMDC has slowly expanded its Iron Ore production capacities. In FY17, the company has registered its highest ever production and sales of 34 million tonnes and 35.6 million tonnes respectively. NMDC has also maintained its sales growth in first two months of FY18 as well and is expected to increase the overall production over the next few years. NMDC is further set to increase iron ore production from its Karnataka mines if the Supreme Court increases or lift the mining cap on iron ore production.

From its current 34 million tons of Iron Ore production, the company has set an internal target to produce 50 million tonnes of iron ore by FY19 with further increasing it to 67 MTPA by FY22. To achieve this target, NMDC can explore its existing untapped iron ore reserves of 2299 million tonnes. At current rate of 34 million tons of production, these reserves of 2299 million tons can last for another 68 years.

2. India Sets an Ambitious Target to Produce 300 million tonnes of Steel: Iron ore is one of the basic raw material required for the production of steel and thereby demand of Iron Ore is linked with production of the steel. Roughly 1.6 ton of iron ore is required to produce 1 ton of raw iron through blast furnace process. From India’s current steel production of 125 million tonnes per year, India has set an ambitious target to produce 200 million tonnes of steel by FY20 and 300 million tonnes by FY30. Such high production of steel would significantly increase the demand for Iron Ore and will thereby give thrust to NMDC’s target of iron ore production described earlier.

3. Augmenting Capacity along with Developing Required Infrastructure: In order to achieve the production of 67 million tons of Iron Ore by FY22, NMDC is:

- Augmenting iron ore capacity: NMDC to commence work on new iron ore deposits in 2 areas of Dep-13 & Dep-4 at Chhattisgarh in the Bailadila sector. In addition NMDC also carried out Iron Ore beneficiation at Bacheli

- Infrastructure for evacuating Iron Ore: NMDC undertook an increase in its infrastructure to deliver iron ore to its customers in the form of a Slurry pipeline from Bacheli to Nagarnar and doubling of railway line from Kirandul to Jagdalpur.

4. Uptick in Price can Significantly Improve Profitability: Currently, International prices are hovering around $60 per ton from its high of $150 per ton in January 2013. It seems that Iron ore price has bottomed out and will not fall below $50 per ton as it has bounced back from $50 level in the past. Even in India, Domestic iron ore price has bounced from Rs. 1700 per ton in July2016 to Rs. 2225 per ton in July2017.

In addition to that, closure of any mines in the world or higher demand of iron ore by China will strengthen the iron ore price. Any uptick in iron ore price will further improve the profitability of company.

5. Monetisation of Steel Plant: NMDC has principally decided to sell its new constructed 3 MTPA steel plant at Nagarnar in Chhattisgarh for which they have appointed an investment banker to find a suitable buyer. So far, NMDC has made a capex of Rs. 13000 crores on the steel plant and expects to realise minimum Rs. 14000 crores from the same. This plant still requires certain amount of capex to become fully operational for which the work is going on. The timing of the sale of steel plant cannot be estimated; however, there is a strong possibility of it finding a suitable buyer. Whenever it happens, the sale of steel plant will generate large free cash flow for the company which they may utilise for rewarding the shareholder in the form of higher dividend or one more buyback as company does not require any fresh fund to expand its current mining business.

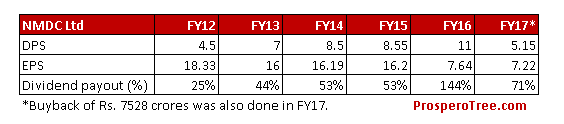

6. Strong Balance Sheet and Higher Dividend Payout: NMDC is a debt free PSU and has Rs. 5300 crores of cash and equivalent on Balance Sheet. This is even after successfully completing its buyback of Rs. 7528 crores in FY17 which reduced its paid up capital quite significantly by 20.2%. NMDC is known for constantly rewarding its shareholder through dividends and buyback of shares. NMDC has been maintaining a very strong dividend payout as can be seen below:

7. No More One off in FY18: NMDC has provided certain one-time expenses on account of provision for closure of certain mines. It includes provision of Rs. 259 crores under MMDR Act 2015, expected credit loss of Rs. 257 crores and write off of investment in subsidiary of Rs. 42 crores totalling to Rs. 558 crores of one time provisions in FY17. As a result of which the profits of NMDC were lower in FY17. However, we expect such one offs will not come in FY18.

Valuation: At the current market price of Rs. 119, NMDC is trading at 37650 crores market cap with Rs. 5300 crores of cash and equivalents on balance sheet and has a dividend yield of 4.3%. In FY17, NMDC did an operating profit of Rs. 3400 crores and assuming the current price of Iron Ore, NMDC should be able to achieve an operating profit of Rs. 3800 crores. In addition to this, the company has spent Rs. 13000 crores on upcoming steel plant completely from its internal accruals which is not yielding any returns so far. The value of steel plant if sold can yield nearly Rs. 13000 crores of free cash flow to the company. Together, value of steel plant and cash on balance sheet works out to be at Rs. 18300 crores which is nearly 50% of current market cap. Considering its operating profits, strong balance sheet comfort from cash and its steel plant, large reserves of ore and increasing production plan, NMDC seems to benefit substantially from the Indian demand of steel and subsequently Iron Ore. We therefore recommend buying at current market price of Rs. 119.

Risk:

- Sharp fall in Iron ore prices globally may adversely affect the profitability of company.

- Weak demand of iron ore by their customers such as JSW, Rashtriya Ispat and other major steel producers who do not have their captive iron ore mines.

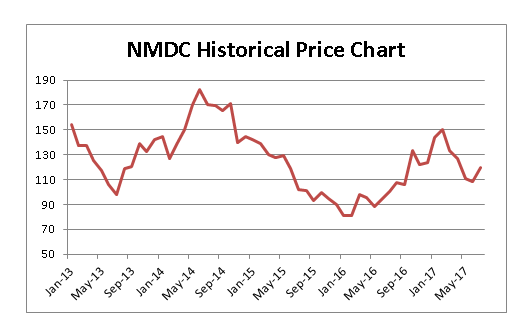

Historical Share Price:

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

- Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

- Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

- Buy: This means buying the concerned stock at current market price.

- Buy on Dips: This means buying the concerned stock on the explained fall in price.

- Hold: This means holding the concerned stock until further update.

- Sell Partial: This means selling half of the existing position in the concerned stock.

- Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.