| Name | Accelya Kale Ltd |

| Type of Report | Fresh Recommendation |

| Report Date | August 28, 2017 |

| Price on Report Date | Rs. 1370 |

| Current Market Cap | Rs. 2045 crores |

| View | Buy |

| Indicative Target Price* | Rs. 2000 |

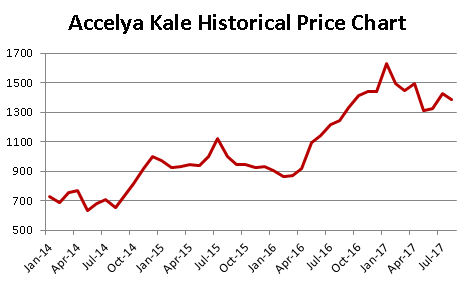

We first recommended Accelya Kale at Rs. 375 in Nov2013 - Accelya Kale: Fly High. Post first recommendation, the stock went up from Rs. 375 to Rs. 1240 and additionally gave dividends of Rs. 130 over the same period making a total return of 266%. In Sep2016, we suggested to exit the stock as suggested here - Accelya Kale: Fly Away with 3.6 times.

Here we re-present Accelya Kale again as a fresh investment idea.

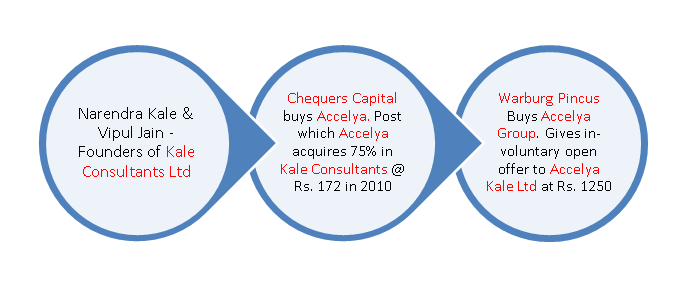

Company Background: Accelya Kale is a leading financial software provider to airlines across globe. Its software helps airlines manage their financial processes and gain insights on their business performance. Originally founded by Mr Vipul Jain and Mr Narendra Kale as Kale Consultants, the duo were able to establish a very strong team to create the best product for revenue accounting function of Airlines. In 2010, Chequers Capital led Accelya took over Kale Consultants and renamed it Accelya Kale Solutions Ltd. Later in 2017, the promoters of the company changed again when Warburg Pincus expanded its interest in financial software space for airlines by acquiring entire Accelya group from Chequers Capital.

Investment Arguments:

1. Ticket Based Revenue Model Provides Strong Revenue Stream: Over last 20 years, Accelya Kale has developed significant domain expertise in providing solutions for managing financial processes of airlines. Due to its best in industry products and ability to establish strong relationships, Accelya group is providing solutions to more than 200 airlines globally. The most important software product of the group belongs to Accelya Kale Solution Ltd and is marketed under the brand 'Revera'. It is the market leader in the field of Passenger Revenue Accounting for airlines industry.

Since 2007, Accelya Kale changed its business model from being a onetime license based offering to a fully outsourced variable fee offering model based on number of tickets processed through its platform. Today most of Accelya Kale revenues come from this fully outsourced model based on the number of air tickets processed by clients through its software. This outsourcing model based on number of tickets processed is executed at its centre known as Managed Process Services (MPS). This gives a strong long term revenue stream for Accelya Kale Solutions.

Long Term Contracts: All clients of Accelya Kale have contracts anywhere from 5 to 8 years. Usually, if an airline starts using one Accelya Kale’s software, it is not too easy for them to change the software provider and the renewals rate is naturally very high.

The ticket based variable fee model along with long term contracts with clients makes Accelya Kale revenue base very strong.

2. Global Air Traffic Growth to Aid Natural Growth: Initially Accelya sold its software product for a one time license fee with a small maintenance fee thereafter. Over time Accelya started providing a complete solution in the form of outsourcing model where the product was sold for a small upfront payment followed by fess based on number of tickets processed within its revenue accounting software. Today, most of its revenues come from the outsourcing model for the company. Due to this, its revenue growth is now linked with passenger growth of the client airlines. Looking at demand for air travel and rising affordability, IATA estimates the air traffic to grow by around 3.7% for next two decades. This means that Accelya should be able to grow well even without any increase in number of clients. Such growth should translate into good operating leverage for companies like Accelya Kale having a relatively stagnant cost base.

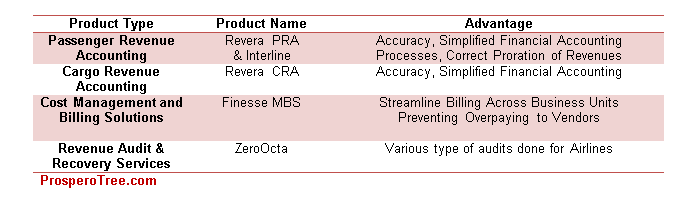

3. Large Product Basket: From being a revenue accounting software provider, Accelya Kale now has multiple product offerings being:

Accelya Kale's Product Basket:

All these above products helps airlines in simplifying tedious financial processes, decrease revenue leakages and bring cost control which eventually improves the cash flows and profitability of airlines. Though most of the revenues for Accelya comes from Revera, these other products have helped Accelya to market its positioning well, establish relationship with new clients, and penetrate deeper with its existing clients.

4. Integration between Accelya and Mercator to help Grow Business: In 2014, Warburg Pincus first acquired Mercator Solutions of UAE and later in 2017 acquired Accelya Group. Before the acquisition of Accelya by Warburg Pincus, RAPID a product of Mercator Solutions was aggressively competing with REVERA a product of Accelya Kale. Now that both these companies are owned by common promoter, the leadership has communicated the integration among these two entities. Accelya Kale is expected to play a central role in the integration exercise as seen from the promotion of John Johnston, CEO of Accelya to become CEO of the combined entity.

Accelya Kale clearly has excellent product profile, higher market share than others, flexible transaction based pricing business model, excellent knowhow backed by a solid team and superior cost structure. All of this should naturally benefit Accelya Kale with reduction in competition in from Mercator Solutions. A similar message of strengthening and growing existing activities of Accelya Kale Solutions Ltd was also communicated in the open offer filings filed by Warburg Pincus.

5. Strong Reputation and Reach due to IATA association: Airlines across the world sell their tickets through different travel agencies. IATA started a settlement service between airlines and travel agencies called "Bank Settlement Processing" or BSP. Accelya is a strategic partner to IATA in this initiative. With this service, airlines get payment for all tickets sold by hundreds of travel agents as a single payment every month. Similarly, travel agencies need to pay a single payment for their dues to all airlines. BSP does the work of settling the accounts of the travel agents on one hand and airlines on the other. Accelya, as a partner to IATA, provides these services to airline industry in 104 countries (out of 171 worldwide). Due to Accelya's exceptionally strong relationship with many airlines and deep domain knowledge, there is a very high possibility of more clients getting enrolled.

6. Potential Clients Wins To Improve Profitability Substantially: Airlines, globally, spent Rs 10,000 cr to Rs 12,000 crores on their IT systems. A large share of these spending is done for systems catering to the functions of Revenue accounting and settlement between airlines. Till today many companies are dependent on in-house IT systems that are often in-efficient. Due to its legacy systems and employee resistance to change, the sales cycle can take 5-7 years for getting new airlines converted from their in-house systems to outsourced systems from independent player like Accelya or Mercator. However, if there are any additional customer wins for Accelya Kale, it would straight away shoot up its bottom line as the company would hardly have any incremental costs to service the same.

7. Strong Balance Sheet with Very High Dividend Payouts: Accelya does not require any significant capital to run its business. This is evident from its very low fixed assets and near zero assets additions in the last few years. It has a debt free balance with nearly 100% of its earnings being distributed as dividends at the current run rate. The company pays a dividend of Rs. 51, making a dividend yield of 3.7%.

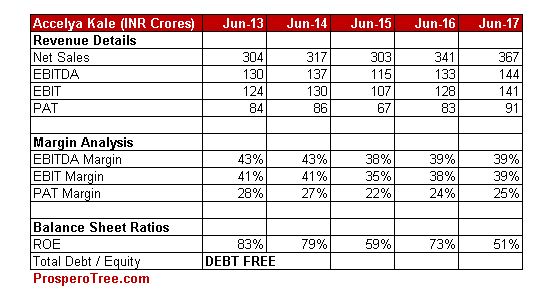

Valuations: At the CMP of Rs 1370, the company is trading at a market cap of Rs 2045 crores. In the year ended Jun2017, Accelya Kale generated profits of Rs 91 crores making it trade at 22 times multiple. With its strong product profile, reducing competition due to integration of Mercator and Accelya, better cost structure and potential client wins, we suggest a BUY on Accelya Kale Solutions at current levels.

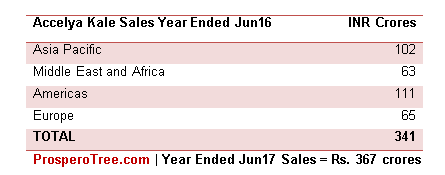

Financial Glance:

Key Risk:

1. Rupee appreciation versus major currencies

Historical Share Price:

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

- Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

- Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

- Buy: This means buying the concerned stock at current market price.

- Buy on Dips: This means buying the concerned stock on the explained fall in price.

- Hold: This means holding the concerned stock until further update.

- Sell Partial: This means selling half of the existing position in the concerned stock.

- Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.