|

Name |

Oberoi Realty Ltd |

|

Type of Report |

First Recommendation |

|

Report Date |

Oct 13, 2017 |

|

Price on Report Date |

Rs. 445 |

|

Current Market Cap |

Rs. 15163 crores |

|

View |

Buy |

|

Indicative Target Price* |

Rs. 800 |

Company Background: Oberoi Realty is a Mumbai based real estate developer having a basket of residential, retail, commercial and hospitality projects. Oberoi is known for large cluster development of luxurious projects catering to the upper middle class and ultra-HNIs. Primarily focussed in Mumbai, Oberoi Realty has already constructed and delivered more than 6 million sqft since inception.

Investment Argument:

1. Operating in the Most Resilient Real Estate Market of India: Nearly all of Oberoi Realty's projects are located in Mumbai which is the most resilient real estate market in India. A host of reasons explain the resilience shown by Mumbai real estate:

-

Commercial Capital: Mumbai is the commercial capital of India and has the busiest ports of India

-

Population Migration: Continuous migration seen from other parts of India to Mumbai due to employment opportunities, academic opportunities and attractive center of art and cinema. This has made Mumbai to be the most densely populated city in the world having a population of more than 2 crores residents.

-

Rich and Wealthy: Mumbai accommodates the highest number of millionaires and billionaires in India

-

Less Availability of New Land Parcels: Over the last few decades, the available free land has become quite scarce making the cost of land quite expensive in Mumbai.

-

Mumbai is locked by Sea on 3 Sides: Mumbai is locked by sea from 3 sides, making it almost impossible for the city to expand.

Like any other asset class, real estate too has its own share of over-valuation periods. However, based on above factors coupled with a strong inherent demand in Mumbai, it has proven to be the most resilient real estate market in India and the world.

2. Unmatchable Brand Strength: Oberoi is known widely for its transparent dealings with customers, suppliers and land sellers. It has an excellent track record of timely execution of projects along with highly qualified and professional team. Clearly, Oberoi is now the most trusted real estate brand in Mumbai and it is, therefore, able to achieve higher realizations than that of its competitors. Its brand power can also be gauged from the fact that it has been able to draw a large number of customers even in it’s under construction projects.

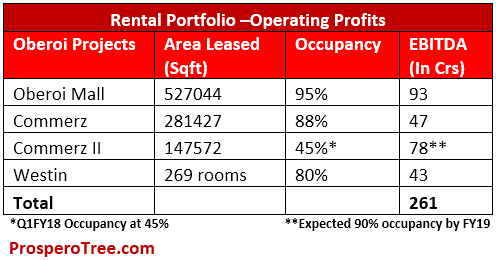

3. Strategic Rental Portfolio: In 2002, Oberoi acquired 83 acres of land in Goregaon East near the Western Express highway. Being an underdeveloped location, they took a strategic decision to develop the social infrastructure first by building a premium retail mall known as Oberoi Mall and a five-star hotel named Westin. Along with the development of residential towers, Oberoi also envisaged demand of commercial real estate in the area and built two towers out of the three planned in that location. Currently, these social infrastructures continue to provide them good rental yield and should be able to contribute an EBITDA of Rs. 270 crores in FY18.

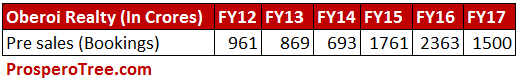

4. Strong Bookings In Spite of Weak Environment: Oberoi has achieved average pre-sales (bookings) of Rs. 1900 crores in 3 years from levels of Rs. 800 crores in FY13. This is in spite of real estate market passing through a tough phase in terms of new bookings and stagnation of price. Oberoi has been able to achieve market share gains against its large and small competitors around its projects. At the same time, Oberoi has kept/maintained a strong pace in terms of construction spending as well.

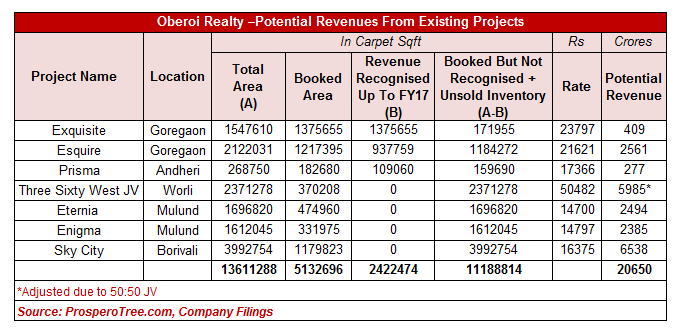

5. Current Projects Pipeline Provides Long-Term Visibility: Oberoi has a large real estate portfolio spread in various parts of Mumbai. Within Mumbai, the ultra-high luxury residential project at Worli is named as Three Sixty West. There will also be an ultra-premium five-star hotel to be managed by Ritz-Carlton. This project is being developed with a Joint Venture partner. All other projects of the company are fully owned by Oberoi and located mainly at Goregaon, Borivali, Mulund & Thane.

We worked on potential revenues from under-construction projects that are yet to be booked in the income statement. The results suggest that if Oberoi is able to sell all its inventory in these projects at current rates, it will have revenues of more than Rs. 20000 crores over next few years.

This is without considering any of following:

- Incremental residential projects from Goregaon for which land is available

- Incremental commercial tower from Goregaon for which land is available

- Potential Mall and commercial tower in Borivali

- Projects on recently acquired 60 Acres land at Thane

- This also does not assume any price increase in the existing projects for long periods of time due to current negativity around real estate pricing.

- Additionally, there could be significant gains coming from the higher FSI

6. Large Unlevered Balance Sheet Provides Scalability: As of FY17, Oberoi Realty has a net worth of Rs. 5726 crores and the net debt of only Rs. 264 crores. Oberoi has primarily funded all its operations from promoter funds, internal accruals and customer advances with little reliance on borrowed funds. This is also replicated from its credit rating of A1+ for its short term commercial papers. For its size, it has the strongest balance sheet in the industry. It is precisely due to this balance sheet, Oberoi will be able to successfully bid for a large prime land parcel within city limits where demand is usually better than outside the cities where demand needs to be created. One such purchase was recently completed by Oberoi at Thane, where it purchased 60 Acres of land behind successful Viviana Mall for Rs. 555 crores from Glaxo Pharma. Having an unleveraged balance sheet along with strong rental income will help Oberoi in scaling up whenever incremental land purchase opportunities come by.

Valuations: Currently, Oberoi Realty is trading at a price of Rs. 445 with a market cap of approximately Rs. 15000 crores. In FY17, the company achieved sales of Rs. 1113 crores with profits of Rs. 378 crores, indicating a net profit margin after taxes of 34%. Oberoi has slowly grown its pre-sales (booking value) to an average of around Rs. 1900 crores per annum.

From its ongoing projects, without assuming any upsides like price rise, additional projects on existing land or higher FSI, Oberoi can achieve revenues of more than Rs. 20000 crores over next 5-7 years. We believe that Oberoi should be significantly able to scale the pre-sales (bookings) per year and has enough projects to support this expansion. Together, the rental portfolio and upcoming projects provide a very strong sustainability of earnings to Oberoi. Even if Oberoi only manages to grow its pre-sales (bookings) at a modest rate, the current market price provides enough upsides. We therefore suggest

Together, the rental portfolio and upcoming projects provide a very strong sustainability of earnings to Oberoi. Even if Oberoi only manages to grow its pre-sales (bookings) at a modest rate, the current market price provides enough upsides. We, therefore, suggest buying on Oberoi at current market price of Rs. 445.

Key Risk:

- Dampening Demand in Real Estate

- Project concentration in Mumbai

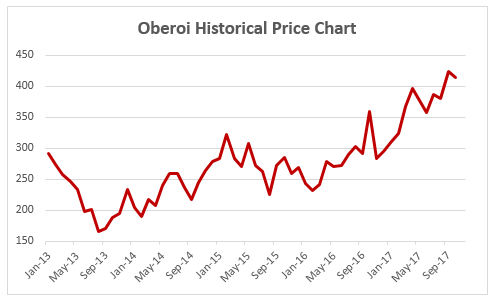

Historical Price Chart:

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

- Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

- Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

- Buy: This means buying the concerned stock at current market price.

- Buy on Dips: This means buying the concerned stock on the explained fall in price.

- Hold: This means holding the concerned stock until further update.

- Sell Partial: This means selling half of the existing position in the concerned stock.

- Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.