This stock recommendation is a part of our Investing section called -"The Timeless Leader Series"

| Name | Pidilite Industries |

| Type of Report | Fresh Recommendation |

| Report Date | 26Nov2014 |

| Price on Report Date | Rs. 430 |

| View | Buy |

| Indicative Target Price* | Rs. 800 |

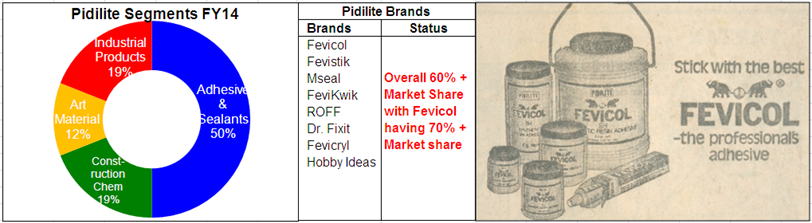

The scene of an elephant and a bunch of bodybuilders chanting “Dum Lagake Haisha, Zor Lagake Haisha” trying to split apart a piece of glued wood evokes memories of the classic old Fevicol advertisement. It’s been almost two decades since this powerful advertisement was telecast, but even today, Fevicol remains the market leader with a 70% market share (in white glue market) thanks to its brand value and sticky customers. This Fevicol comes from the stable of Pidilite Industries which was founded in 1959. Currently, Pidilite has sales of Rs. 4,200 crores and offers a diverse range of adhesive products that fulfills consumer requirements. Nearly 50% of Pidilite revenues come from consumer adhesive brands like Fevicol, Fevistik, Fevikwik, Mseal and Steelgrip. Another 30% sales is garnered from construction chemicals and art materials which includes brands like ROFF, Dr. Fixit, Fevimate, Hobby Ideas and Fevicraft. These products find applicability across a very diverse set of users – carpenters, painters, plumbers, mechanics, households, students, offices and industries.

Fevicol is a 53 years old brand; the first 26 years elapsed in building a brand and establishing the trust of consumers. This was mainly achieved by maintaining its product quality, connecting with carpenters, evolving its packaging and establishment of a formidable distribution network. In 1960s the company recorded sales of Rs. 1 crore which increased to Rs. 10 crores in 1983. By this time, the Fevicol brand was fairly established.

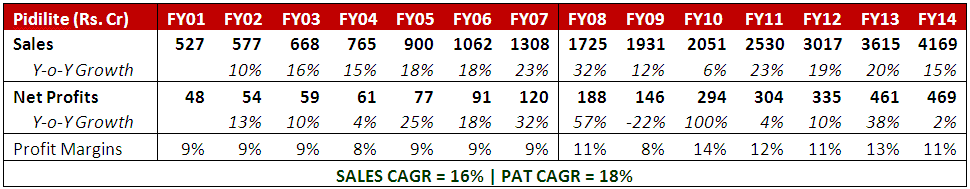

Thereafter, with introduction of new small sized SKUs (Stock Keeping Units), deepening of distribution network, and a series of brilliant advertisements, the company was able to create a pull for its brand that led to a strong increase in its sales from Rs. 10 crores in 1983 to Rs. 1,000 crores in 2006, 100 times sales in 23 years. Even if we consider, Pidilite’s growth over the last 14 years, it is quite commendable with sales growth of 16% CAGR and a profit growth of 18% CAGR. The striking aspect of Pidilite’s story is its consistent growth as seen from the table below.

Undoubtedly, over the years, Pidilite has achieved stupendous growth and created strong brands. The future also looks promising because of a host of reasons as stated below:

Investment Arguments:

- Leadership Position: Prior to Fevicol, it was unheard of to have a brand in the adhesive category. But, with Pidilite’s years of brand building exercises, Fevicol has become a generic name for adhesives, thereby reflecting the brand’s equity. Fevicol’s adhesive properties are perceived to be as strong as the elephant – the brand mascot of Fevicol. Hence, Fevicol emerges to be the preferred brand since the end-use applications of adhesives carry high cost-of-failure with a relatively low cost-of-usage. Pidilite commands strong pricing power due to it’s market leadership position with 60% market share and a differentiated product range. This helps Pidilite to maintain its margins for a sustainable period of time. Even when the Indian economy was not doing too well in the last 5 years, the sales for Pidilite has increased at a CAGR of 15%. With the economic recovery in sight, the domestic sales could witness further traction and can lead to a 20% CAGR growth for 3-5 years period.

- Strengthening internal capabilities – Making way for outsiders in top management: Pidilite has embarked on a journey transforming itself from a family-driven company to a professionally-run organization. In the last 5 years, the company has inducted 80 top management professionals; today, the family is nearly dis-engaged from the day to day operations with marquee positions of CFO and CIO being handled by professionals. There are only a handful of companies that are able to chart out such a transition while simultaneously retaining the cultural ethos of the organization. The company refrained from giving pink slips to its employees but rather re-skilled the people in redundant positions. It looks like Pidilite may be successful in scripting this metamorphosis.

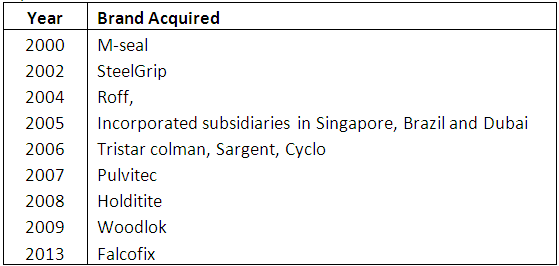

- Acquisitions paying off well: Post 2000, Pidilite consciously sought opportunities to enter new niche products in the adhesive and sealant space, primarily through a string of acquisitions. Due to debt free balance sheet and a high operating cash flow business, Pidilite could afford these acquisitions. Some of the acquisitions that have really paid off well are M-seal, Steel Grip, Roff among others. The aggression shown by Pidilite can be seen from the table below. The buyouts are a conscious attempt by the company to curb competition at all price points across various products.

- Focus on innovation and deeper penetration: Most of their products are developed in-house with the help of a strong, research-driven innovation overlaid with consumer insights. For example, a variant of Fevicol -‘Fevicol Marine’ was launched for furniture which is in constant touch with water. Such innovations have always been successful in creating new niche markets for themselves.They are present in more than 60,000 outlets across the country. In order to penetrate deeper, they have formed a separate team and also a separate vertical to establish connect with markets having a population size of less than 10,000.

- Opening new markets: Pidilite has 14 overseas subsidiaries - 4 direct, 10 step-down with operations encompassing US, Brazil, Thailand, Singapore, Dubai, Egypt and Bangladesh. The revenue from these markets is only Rs. 421 crores and major contributors to revenue are US and Brazil. The company has been bearing the brunt of a global slowdown and political turmoil in some geographies. However, Bangladesh has reported sales growth of 36.4% despite the political unrest and market disturbance for 5 months during last year. Presently, overseas operations contribute to a meagre ~10% of revenues, nevertheless, there is a lot of headroom to grow; the likelihood of success is higher for companies like Pidilite which have demonstrated willingness to experiment, innovate and and learn.

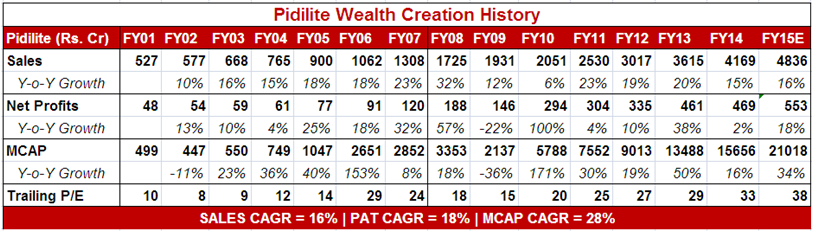

Wealth Creation: Since the last 15 years, Pidilite has registered sales and profit growth of 16% CAGR and 18% CAGR respectively. This can be attributed to its powerful brand status, wide product portfolio and deep distribution network which has translated to a market leadership position combined with a strong pricing power. We believe in what Warren Buffett says about economic moats, “In business, I look for economic castles protected by unbreachable ‘moats’.” We think Pidilite not only has a strong moat, but an ever increasing moat such that no other competitor will be able to easily rattle Pidilite’s position.

On the financial side, Pidilite has an extremely strong balance sheet, robust cash flows, excellent dividend payouts (approximately 33%) and a steady return on capital employed that makes for a strong case of investing in Pidilite at attractive valuations.

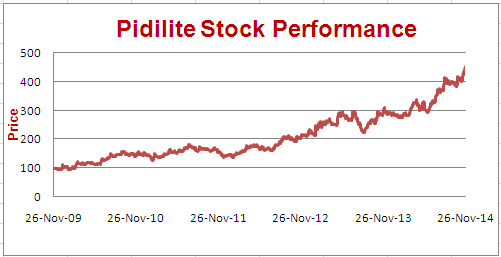

In the last 15 years, the stock of Pidilite has given CAGR returns of 28% (dividends extra). In the last decade, Pidilite has traded at an average of 25 times its trailing multiple. Currently, Pidilite is valued at 38 times earnings multiple and may sound expensive. However, if you are a believer of the India story for the next 4-5 years, we would suggest investing in Pidilite at CMP of Rs. 420-440 in a SIP manner.

In a nutshell, the stock should perform well and still make for 20%-25% CAGR story with immense safety. However, those investors who think they can double their money in 3 years, should not invest in Pidilite. For the satisfied souls, this stock stands a chance to can become a doubler in 4-5 years with a much lower headache.

Historical Stock Price

*Achievement of Target Price does not imply Sell. We will explicitly release a Exit/Partial Sell Report at an appropriate time.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under: