|

Name |

Jagran Prakashan Ltd |

|

Type of Report |

Fresh recommendation |

|

Report Date |

March 22, 2018 |

|

Price on Report Date |

Rs. 164 |

|

Current Market Cap |

Rs. 5100 crores |

|

View |

Buy |

|

Indicative Target Price* |

Rs. 240 |

Company background: Jagran Prakashan is a print media company having the largest readership and highest circulation base in India. It publishes 8 newspapers & 1 magazine in 5 different languages across 13 states. This is achieved through 37 different printing facilities spread across multiple locations within those states. Additionally, Jagran Prakashan is also holds 70% stake in Music Broadcast Ltd, which operates 39 FM stations and 48 web stations. Music broadcast is very well known for its radio frequency brand 91.1 FM - Radio city.

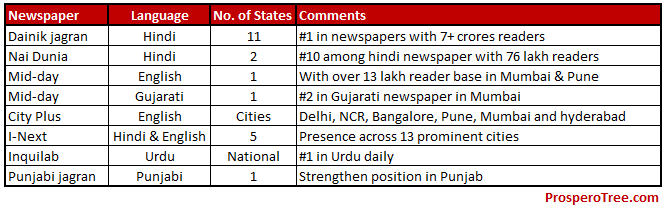

Jagran Prakashan's Print Media Presence:

Investment Argument:

1. Print Business is Not Dying; in-fact it's Growing: Many people feel that print media is de-growing and facing the tough time from electronic media. However, the size of Indian print media has continuously grown and is defying global trends as of now. As per the Indian Readership Survey 2017, in the last 4 years, new readers have increased by 11.2 crore and total readership reached to 40.7 crores. In the same duration, the Hindi Dailies saw a stupendous growth of 45% with its readership reaching 17.6 crores where Jagran has a major presence in 13 states. These statistics prove that print media is growing.

Revenue Streams: Most print media companies have two major sources of revenues.

-

Circulations revenues which are mainly dependent on readership increase

-

Ad revenues which are mainly dependent on ad spending

It is expected that both of the above category of revenues will see a modest but sustained growth for the industry due to the major trends explained below:

a) Higher literacy rate: As discussed, there has been a 45% increase in the last 4 years in the Hindi dailies. This is mainly due to increase in literacy rates especially among the women and rural areas of India. Over the next few years, India will continue to have decent growth in literacy helping the circulation revenues for print media to grow over a period of time. Additionally, India's has a high population growth when compared with many other countries, which will add up to the future readership pool.

b) Government & Business Ad spending: The big advertising revenues comes from the spending of both, the government and the private businesses. The government regularly requires to spend on the advertisements due to a continuous need to reach the masses for government-sponsored schemes, creating awareness, giving tenders, and informing the achievements of the government among others. Additionally, in a growing economy like India, where markets are expanding and competition is increasing, mid and large companies continue to expand their advertising spends to protect and grow their businesses. It is therefore said that the growth of advertisement revenues is nearly 1.5 times that of the GDP growth of the country. All of this should ensure the consistent increase in the advertisement spends through print media among others.

c) Political parties spending: Additionally, political spending in India needs a special mention in the context of ad spends. India being in election mode for almost every year with some or the other type of elections -Panchayat, Municipal, State or Central elections. This leads to one more additional source of income, especially for print media. For example, in 2018, there are 6 states elections and 2019 will have general parliament election.

Together all of this should lead to decent growth in print media over the next few years.

2. Solid Unshakable Position: Dainik Jagran, a Hindi news daily, is ranked as a number 1 newspaper with more than 7 crores readers across 11 states where it is available. Even within most of these 11 states, Dainik Jagran ranks as number 1 or number 2 in terms of state level readership market share. This suggest of an enviable and unshakable position established over decade or so. Globally, most cities have only 2 or 3 major newspapers, the success of any newspaper is mainly determined by:

-

Coverage of local news and events along with national news and events

-

Convenient source of information

-

Door-to-door delivery of newspaper through an efficient distribution network.

-

Newspapers customers are quite habitual and will not change the newspapers easily. It is extremely hard to be replace with something else.

-

Economical annual subscription makes it quite an attractive proposition. In India, the costs are nearly below Rs. 1000 per year

In all the above parameters, Jagran Prakashan scores extremely well and therefore has undoubtedly been able to have high market share and is expected to remain same for a reasonable period of time.

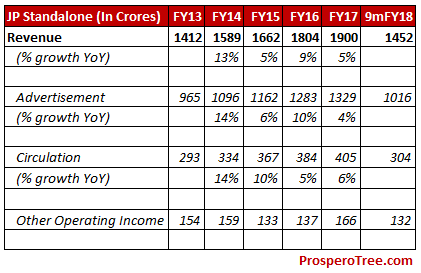

3. Operating Leverage Is Quite High For Print Media: Jagran Prakashan have a very high operating leverage in its print media business. In last 11 years, the print business revenue grew by 4 times from Rs. 481 crores in FY06 to Rs. 1900 crores in FY17 whereas profits have increased by a stupendous 10 times from Rs. 32 crores to Rs. 316 crores due to very high market share and economies of scale kicking in. Even if JP grows modestly in terms of sales, its profit will increase substantially higher due to the operating leverage built into such businesses.

4. Radio Business – An Additional Growth Driver: Jagran Prakashan has a strong presence in radio business through its 70% subsidiary company – Music Broadcast Ltd (MBL). Radio Business provides a diversity of revenue and de-risking of the business model. Currently, Music Broadcast operates 39 radio station across 12 states and enjoys 21% market share. Radio business is expected to further grow inorganically by the acquisition of radio stations from existing players who will soon be able to sell the same in tier II and tier III cities once the lock-in timelines are expired.

5. Good Capital Allocator: The print media business is the cash cow for the company and annually generates cash profit of around Rs. 400 crores. Jagran has effectively utilized the cash generated for creating the wealth for its shareholder through acquisitions, increasing its printing facilities, buyback and dividends.

Year-wise acquisitions and buybacks:

-

2010 – Midday

-

2012 - NaiDunia and NavDunia

-

2014 – Buyback

-

2015 - Music Broadcast Ltd

-

2017 - Buyback

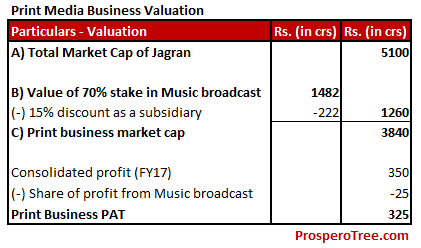

Valuation: At the current market price of Rs. 164, Jagran Prakashan is trading at Rs. 5100 crores market cap with Rs. 452 crores of cash and cash equivalent. Currently, Jagran is net debt free and have reported consolidated PAT of Rs. 330 crores of trailing 4 quarters upto Dec2017, indicating a trailing price to earnings multiple of 15 times.

In case if we consider Jagran Prakashan only on its standalone business of print media after adjusting for the valuations of Music Broadcast Ltd which is a separate listed company, it is available at a 12 times trailing price to earnings multiple having a phenomenal business and strong cash flow generation along with steady growth in its cash flows. We, therefore, recommend to BUY at Jagran Prakashan at the current market price of Rs. 164.

Risk:

-

Rising Newsprint Cost: Newsprint cost is 27% of the total revenue. Recently, the newsprint price has increased. In order to maintain the readership, many times publisher may not pass on the cost to readers and bear the hike.

-

Competition: Other than the peer competition, TV, radio and digital media are the strong competitor to the print business

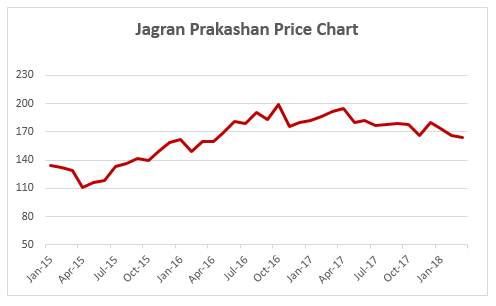

Historical Price Chart:

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

1. Explanation of Type of Report

-

Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

-

Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

2. Explanation of Time Horizon: All the Fresh Recommendation reports in the investing section have a view of 3-5 years.

3. Explanation of Views: Views can be any one among these - Buy, Buy on Dips, Hold, Sell Partial, Exit

-

Buy: This means buying the concerned stock at current market price.

-

Buy on Dips: This means buying the concerned stock on the explained fall in price.

-

Hold: This means holding the concerned stock until further update.

-

Sell Partial: This means selling half of the existing position in the concerned stock.

-

Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.