|

Name |

CDSL Ltd |

|

Type of Report |

Fresh recommendation |

|

Report Date |

April 26, 2018 |

|

Price on Report Date |

Rs. 288 |

|

Current Market Cap |

Rs. 3010 crores |

|

View |

Buy |

|

Indicative Target Price* |

Rs. 450 |

Company Background: CDSL is one of the two security depositories promoted by BSE Ltd with the objective of providing convenient, dependable and secure depository services at an affordable cost to all the market participants. In 2017 to comply with SEBI directions, BSE divested its partial stake to reduce its holding from 50.05% to 24% through offer for sale.

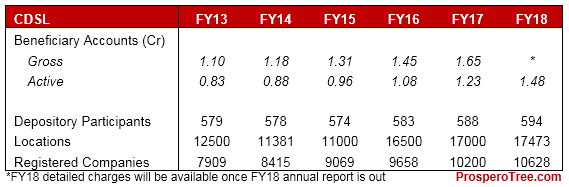

Strength of the Company: In terms of number of accounts, CDSL has increased its market share from 44% in FY17 to 46.5% in FY18 by aggressively acquiring 63% of new businesses generated for the industry through opening of new Beneficiary Owner (BO), Depository Participants (DPs), locations and registering new companies.

Investment Arguments:

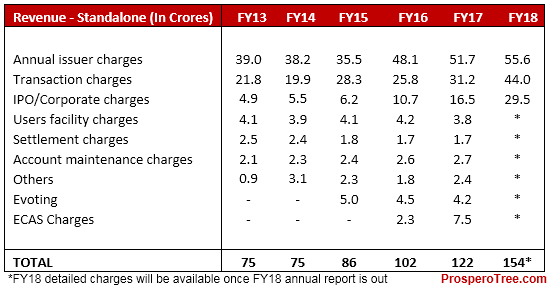

1. Multiple Revenues Streams that are growing: CDSL has multiple types of charges being collected as below. Most of the revenue segments have seen a consistent increase over its past and is further expected to show modest but consistent rise over a long period.

Annual Issuer Charges: CDSL receives annual fees from the companies registered with them for providing the depository services. The fees are higher of either Rs. 11 per folio or minimum annual fees on the basis of paid-up capital. Currently, 83% of companies pay fees on ‘minimum slab basis’ whereas remaining 17% pay on ‘per folio basis'. However, in terms of revenues, only 42% comes from 'minimum slab basis' whereas 58% comes from 'per folio basis'. As more investors open demat accounts and widen the shareholding base of companies, many existing companies annual issuers charges may increase as they shift from 'minimum slab basis' fees to ‘per folio basis’ fees. Additionally, the issuer charges are fixed after the approval from SEBI. The last upward revision was approved in 2015 and next revision is expected in 2020.

- Transaction Charges: CDSL charges an average of Rs. 5 per debit transaction (i.e. only on outgoing). Though transaction charges income is variable and linked with market activities, CDSL has seen its transaction charges income growing consistently over the past few years. As the financial market participation theme in India is progressing well, it is expected that capital market activity will increase sustainably leading to increasing transaction charges for CDSL. Out of 594 DPs with CDSL, 503 are stockbrokers who usually have more active accounts and execute more trade than professional DPs like banks.

- IPO / Corporate Action Charge: CDSL generates revenue from the issuer on the fresh issues through IPO, FPO, Right Issues / OFS and corporate actions like Bonus, Spilt, etc. CDSL provides pre-application verification services to the issuer at Rs. 2 per application and Rs. 10 on each allotment. Revenue under this head is expected to grow further due to the strong upcoming pipeline of IPOs. In FY18, there were 45 companies on the mainboard and 155 companies on SME platform have raised the funds through IPO.

- Other revenue streams: CDSL has a set of other services for which it charges in fixed / variable formats like E-voting for shareholders, E-CAS (consolidated account statement) for shareholders, user facility charges (online facility for off-market transfers), account maintenance charges to corporates and settlement charges to stock members. All of these services have received a good response and the associated revenues can see consistent increase over the next 3-5 years.

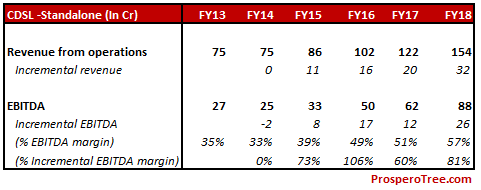

2. Higher Operating Leverage: Operating expenses of CDSL are quite fixed in nature. Any increase in revenues should result in higher EBITDA increase. The following table provides the information about the incremental EBITDA on incremental revenue for CDSL.

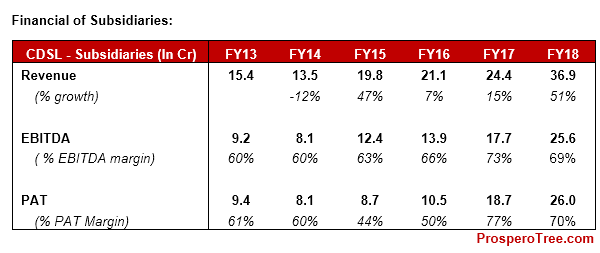

3. Diversified Businesses through Subsidiaries: In order to diversify the business and sustain the growth, CDSL operates different business verticals through its following subsidiaries:

a) CDSL Ventures Limited (CVL): CDSL operates the following businesses through its 100% subsidiary CVL:

• KYC Registration Agency (KRA): CVL is the largest KYC Registration Agency (KRA) in India for capital market intermediaries and enjoys 65% market share. To participate in capital market every participant has to undergo a KYC process. Once the KYC for the participant is done, the capital market participants need not to undergo the same process again. These KYC records are used multiple times and CDSL charges the intermediaries whenever these KYC details are registered or downloaded by them.

• National Academic Depository (NAD): NAD will be an online store house of academic records like degrees, diplomas, certificates, mark sheet among others in digital format and helps ensure data integrity. Totally 231 academic institutions and 47 universities have signed letter of intent with CVL to digitalized academic record. As per government guideline, CVL can collect fees for this service only from September 2019.

• Registrar and Transfer Agent (RTA): In order to encash securities depository expertise, CVL will commence RTA services very shortly. It has already received required approval and is in the process of setting up the necessary infrastructure. This business is a natural extension for CVL due to its common functionality between depositories and RTA business. This business promises to create perpetual revenue income for CDSL.

• e-KYC: CVL will act as a KYC User Agency (KUA) and Authentication User Agency (AUA)

• C-KYC: CVL will act as a central KYC for all the data at one place

• OLAO: Online account opening

• E-Sign: electronic signature based on aadhaar number

• Claim registry for life insurance companies that offers Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

b) CDSL Insurance Repository Services (CDSL IR): CDSL has promoted 54.75% subsidiary company CDSL IR along with other major insurance companies to provide insurance policyholders a facility to keep insurance policies in electronic form. CDSL IR had tied up with 22 life insurance companies and 15 general insurance companies for holding policies in electronic form. The repository has opened nearly 3.21 lakh e-insurance accounts as on 31 March 2017.

c) CDSL Commodity Repository Services (CCRL): CDSL has set up 100% subsidiary CCRL a commodity repository, to establish and run on the lines of securities depository. MCX and BSE have expressed their desire to take up 24% stake each in CCRL as MCX does not have its own depository while BSE is establishing its own commodity exchange.

The Subsidiaries of CDSL are operating in diversified business and generating higher EBITDA margin than CDSL itself.

4. Digital Transformation: Country is moving towards digitalization. i.e. from physical to paperless. Dematerialization is a process by which BO can get his physical holding converted into electronic form. The benefits of dematerialization are transparency, clarity about legal title and elimination of risk like theft, misplace, duplication, forgery, etc. This trend towards dematerialization is picking up steam especially for unlisted companies and may become prominent for land records, banks & corporate FD, saving certificates of post office and many more financial instruments as time passes. In short, the transformation towards the digitalization will open the floodgates of opportunities for CDSL in time to come.

5. Boost for profits from Tax Reduction: CDSL used to pay income tax at 30% plus surcharge on taxable PBT. In Union budget 2018 corporate income tax for FY18-19 has been reduced from 30% to 25% for companies whose turnover is less than Rs. 250 crores in FY16-17. CDSL has reported turnover of Rs. 122 crores at standalone level in FY16-17. So, CDSL's current year PBT (FY19) will be taxed at 25% plus surcharges. The net reduction of income tax rate will be 5.82% and therefore the profit growth assuming everything else constant will be around 9% without any growth in PBT.

6. Strong Balance Sheet: CDSL is a debt free company having a cash and cash equivalent worth Rs. 550 crores. Healthy cash and investment in subsidiaries make CDSL balance sheet very strong and robust which permits CDSL to enter into new business line even if it requires high net worth parameters. For instance, the commodity repository business setup required Rs. 50 crores net worth condition which was easily fulfilled from its balance sheet support.

Valuation: At the current market price of Rs. 288, CDSL has a market cap of Rs. 3010 crores and an FY18 profit of Rs. 104 crores indicating a price-earnings multiple of 29 times on FY18 earnings.

Considering balance sheet strength, business longevity and sustainability, steady rise in revenues with increasing equity market participation and movement towards digitization of records supported by new ventures through subsidiaries, CDSL looks to have a strong road ahead. On the financial matrix, its business provides strong cash generation capacity, high EBITDA margin, low capital requirement and high dividend payout makes CDSL attractive at the current market price. We, therefore, suggest to BUY CDSL.

Risk:

-

Slowdown in capital market: CDSL income is linked with capital market activities. Any slowdown in capital market may affect the profitability.

-

Alternative to KRA business: Introduction to any other alternative KYC method may affects the KYC business of CVL

-

Delay in commencement of new activities: CDSL has initiated the RTA and commodities repository. Any delay or slow pick up of these activities may affect the profitability.

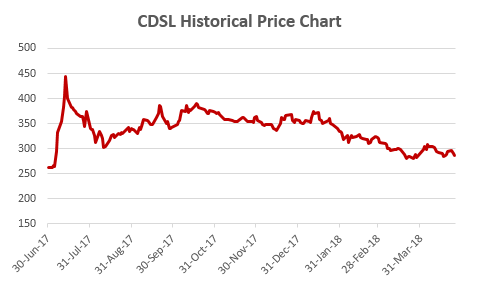

Historical Price Chart:

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

- Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

- Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

- Buy: This means buying the concerned stock at current market price.

- Buy on Dips: This means buying the concerned stock on the explained fall in price.

- Hold: This means holding the concerned stock until further update.

- Sell Partial: This means selling half of the existing position in the concerned stock.

- Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.